Loading

Get Enrollment And Authorization For E-services Program - Florida ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Enrollment And Authorization For E-Services Program - Florida online

Completing the Enrollment And Authorization For E-Services Program form for Florida is an essential step for businesses looking to manage their taxes and fees electronically. This guide will provide you with a clear, step-by-step approach to filling out the form online, making the process straightforward and efficient.

Follow the steps to complete your enrollment effectively.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

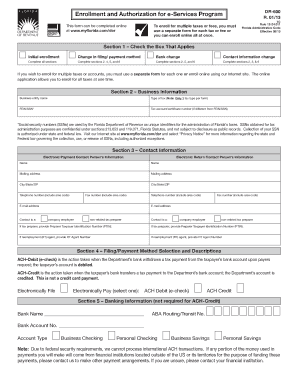

- Determine which of the enrollment options applies to you by checking the appropriate box in Section 1. Options include initial enrollment, change in filing/payment method, bank change, or contact information change.

- If you selected 'Initial Enrollment,' ensure to complete all sections of the form. If you are changing your filing/payment method, you will need to fill in Sections 2, 4, 5, and 6.

- For Section 2, provide your business information. Enter your business entity name, type of tax (note: only one tax type per form), FEIN/SSN, and tax account/certificate number if applicable.

- In Section 3, fill out the contact information for the electronic payment and return contact persons. Provide their names, mailing addresses, and contact numbers. Specify if they are company employees or non-related tax preparers.

- Move to Section 4 to select your filing/payment method. Choose between ACH-Debit (e-check) or ACH-Credit and make sure to read the descriptions to understand each method.

- In Section 5, provide your banking information if you selected ACH-Debit. Include the bank name, ABA routing number, account number, and account type (business or personal).

- Complete Section 6 by authorizing and agreeing to the terms. You will need to provide your signature, title, printed name, and telephone number. A second signature is required if it’s a dual signature account.

- Review all sections to ensure accuracy and completeness. Once you are satisfied with the information entered, you can save changes, download, print, or share the completed form.

Complete your enrollment online today to manage your tax and fee payments with ease.

The following states have no income tax and don't require state W-4s: Alaska. Florida. Nevada.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.