Loading

Get City Of High Point Revenue Collection Division Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the City Of High Point Revenue Collection Division Form online

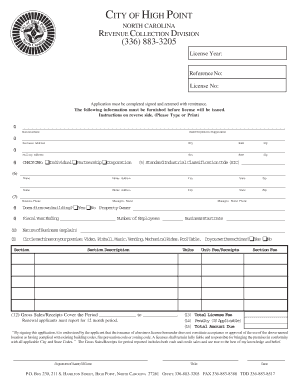

This guide provides clear instructions for successfully completing the City Of High Point Revenue Collection Division Form online. Whether you are applying for a new business license or renewing an existing one, this step-by-step approach will help you navigate each section effectively.

Follow the steps to complete your application smoothly.

- Click ‘Get Form’ button to obtain the form and open it in your chosen editor.

- Provide the license year and reference number in the designated fields. Ensure you type or print this information clearly.

- Enter your business name and, if applicable, the parent corporation name. Ensure that the details match official documents.

- Fill in your business address by providing the street name, city, state, and zip code appropriately.

- If your mailing address differs from your business address, complete the mailing address section with the same level of detail.

- Indicate your business structure by checking the appropriate box for individual, partnership, or corporation.

- Input the Standard Industrial Classification (SIC) code if known, as this helps classify your business's activities.

- List the names, home addresses, and home telephone numbers of all owners or partners. For corporations, provide details for the president and secretary.

- Fill in the business phone number, and provide the manager's name along with their home address and telephone number.

- If applicable, provide the name of the property owner or lessor from whom you are renting or leasing the business premises.

- Indicate the fiscal year ending date, number of employees, and business start date to complete this section.

- Clearly describe the nature of your business, detailing what your business does in a few words.

- Specify the gross sales/receipts period you're reporting and ensure this covers a 12-month timeframe for renewal applicants.

- Complete the license fee calculations by recording the total license fee based on your gross sales, penalties, and total amount due.

- Finally, review the form for accuracy, sign it, and include the date. Once finished, save your changes, download the form, and prepare for submission.

Submit your completed City Of High Point Revenue Collection Division Form online to ensure compliance and maintain your business operations.

What is the sales tax rate in High Point, North Carolina? The minimum combined 2023 sales tax rate for High Point, North Carolina is 6.75%. This is the total of state, county and city sales tax rates.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.