Loading

Get Loan Discharge Application: False Certification (ability To ... - Floridastudentfinancialaid

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LOAN DISCHARGE APPLICATION: FALSE CERTIFICATION (ABILITY TO BENEFIT) online

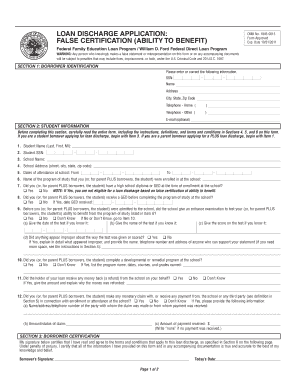

Filling out the Loan Discharge Application for false certification of ability to benefit can be essential for those seeking to discharge federal loans under this specific provision. This guide will help you understand the necessary steps and information required for completing this application accurately.

Follow the steps to complete your loan discharge application online.

- Press the ‘Get Form’ button to access the Loan Discharge Application and open it for editing.

- In Section 1, fill out your borrower identification details, including your Social Security Number (SSN), name, address, city, state, zip code, home telephone number, other telephone number, and email (optional). Ensure all information is accurate.

- Proceed to Section 2, Student Information. If you are a student borrower, begin with Item 3. For parent borrowers, start with Item 1. Complete the required fields such as student name, SSN, school name, school address, dates of attendance, program of study, and other related questions regarding high school diploma or GED status.

- Continue to answer the questions regarding any entrance examinations, remedial programs, refunds received, and monetary claims. Provide detailed information as requested, including any supporting details or documentation related to your claims.

- In Section 3, certify your information by signing and dating the application, confirming that you have read the terms and conditions outlined in Section 6.

- Review Section 4 for additional instructions. Make sure to type or print using dark ink and follow the date format of month-day-year (mm-dd-yyyy). If more space is needed, attach separate pages, clearly indicating the relevant item numbers.

- Finally, send the completed application and any attachments to the appropriate address indicated in Section 8. Ensure you keep a copy for your records.

Complete your loan discharge application online today to take a step towards resolving your loan issues.

If you have federal student loans and are currently enrolled or recently left a college or university that has shut its doors, you may be able to discharge (cancel) your loans if you apply for a loan discharge . ... You may have to pay income taxes if you get your student loans discharged when your school closes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.