Loading

Get Monthly Return Of Bpayrollb Tax P6 Pg12009 Update

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Monthly Return Of Payroll Tax P6 PG12009 Update online

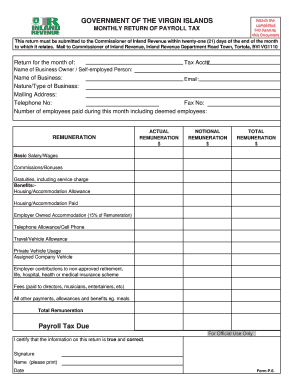

Completing the Monthly Return of Payroll Tax P6 PG12009 Update is essential for employers and self-employed individuals to report payroll tax. This guide will provide you with clear, step-by-step instructions on how to successfully fill out the form online.

Follow the steps to complete your monthly return accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor for completion.

- Fill in the return month you are reporting for, as well as your tax account number. Ensure the details are accurate.

- Input the name of the business owner or self-employed person along with the name of the business, email address, nature of the business, mailing address, telephone number, and fax number.

- Indicate the total number of employees paid during the month, including deemed employees.

- Provide details under the 'Remuneration' section by entering actual remuneration amounts for each type of compensation, such as basic salary, commissions, bonuses, and any benefits.

- Calculate the total remuneration by summing all contributions listed in the remuneration section.

- Determine the payroll tax due based on the total remuneration calculated and add that information accordingly.

- Sign and print your name on the document to certify that the information submitted is accurate and truthful, and include the date of signing.

- Once all sections are completed, review the form for accuracy before saving your changes. You can then download, print, or share the completed form as needed.

Complete your Monthly Return of Payroll Tax online to ensure timely and accurate reporting.

Income and FICA tax return requirements Most employers are required to file Form 941, Employer's Quarterly Federal Tax Return, to report both the federal income taxes you withheld and the FICA taxes you withheld and paid during a calendar quarter.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.