Loading

Get Uniform Residential Loan Application - Mvm Mortgage Group

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Uniform Residential Loan Application - MVM Mortgage Group online

Completing the Uniform Residential Loan Application is a crucial step in securing a mortgage. This guide provides clear and user-friendly instructions tailored to ensure a smooth online application process.

Follow the steps to effectively complete your loan application.

- Click the ‘Get Form’ button to access the application form and open it in your preferred online editor.

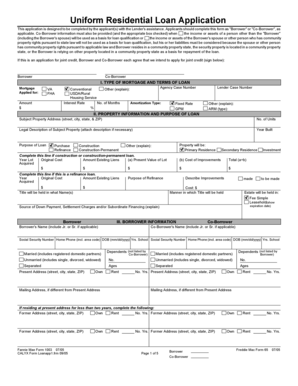

- Begin by filling out your type of mortgage and loan terms in section I. Select the mortgage type you are applying for, and enter the requested loan amount and interest rate. Ensure you complete all relevant fields, including case numbers if applicable.

- Proceed to section II to provide property information. Fill in the subject property address, number of units, year built, and the purpose of the loan. If applicable, include additional details related to refinancing or construction.

- In section III, input the borrower and co-borrower information. Include full names, social security numbers, phone numbers, dates of birth, education details, and marital status. Remember to include any dependents as necessary.

- Section IV requires your employment information. Enter the employer's name and address, position, years at your job, and your monthly income. If you have held more than one position in the past two years, be sure to document this as well.

- Move to section V for your monthly income and combined housing expense information. Accurately report your gross monthly income and all housing expenses to provide a detailed view of your financial situation.

- In section VI, list your assets and liabilities. Provide all necessary financial information and ensure you account for any debts and worth to give the lender a comprehensive view of your financial standing.

- Section VII covers details of the transaction including purchase price, alterations, and estimated costs. Ensure to provide accurate figures to avoid any discrepancies.

- Complete section VIII by answering any relevant questions regarding your financial history. Be honest and thorough; responses may impact your application eligibility.

- Finally, review all sections for accuracy. If satisfied, proceed to sign and date the application. You can then save changes, download, print, or share the completed form as necessary.

Start your application process now to take the next step toward homeownership!

What type of information is asked for in the declarations section VIII on a uniform residential loan application? The address of the home, the number of units and the estimated home value. Whether you intend to live in the home, rent it out or use it as a second home.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.