Loading

Get Child Tax Benefit Application (rc66) - Michael O'leary Cga

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

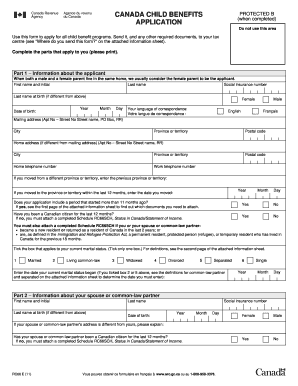

How to fill out the Child Tax Benefit Application (RC66) - Michael O'Leary CGA online

This guide provides clear, step-by-step instructions on how to complete the Child Tax Benefit Application (RC66) online. By following these instructions, you will be able to fill out the form accurately and ensure that your application is submitted correctly.

Follow the steps to effectively complete your application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part 1, which requests information about the applicant. Fill in your last name, first name, and initial, as well as your social insurance number. Complete the date of birth field and indicate your preferred language of correspondence. Provide your mailing address and home address, if different. Include your home and work telephone numbers.

- Continue to answer questions regarding your current marital status. Select the appropriate option, such as 'Married,' 'Living common-law,' or 'Separated.' If applicable, note the date your marital status began.

- Proceed to Part 2 to fill in details about your spouse or common-law partner, if applicable. Provide their last name, first name, date of birth, social insurance number, and indicate if their address differs from yours.

- Move to Part 3, which requires information about your child(ren). For each child, include their first name, last name, place of birth, and date of birth. Indicate whether you share custody and if you have been primarily responsible for their care since birth.

- If applying for more than three children, attach a separate sheet with the required information for additional child(ren) and sign it.

- Complete Part 4 if there has been a change of recipient regarding the child(ren). Include the name, address, and telephone number of the previous caregiver or agency.

- Finalize by signing Part 5 to certify that all information is accurate. Ensure your spouse or common-law partner also signs if required.

- Once you have filled out the form, save your changes. You may then choose to download, print, or share the completed application as needed.

Ensure you submit your application online for timely processing.

What is the RC66SCH form? When you file your income tax you may use form RC66SCH to state your status in Canada if you are a new Canadian citizen, became a resident in the last 2 years, or a permanent resident, and you want to apply for the Canada Child Benefit (CCB).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.