Loading

Get Loan Call Questionnaire For Status Of Loan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Loan Call Questionnaire For Status Of Loan online

Filling out the Loan Call Questionnaire for Status of Loan is an essential step in the loan process. This guide will provide step-by-step instructions to help you accurately complete the form online and ensure smooth communication with your lender.

Follow the steps to complete the Loan Call Questionnaire efficiently.

- Click ‘Get Form’ button to access the Loan Call Questionnaire for Status of Loan and open it in your preferred online editing tool.

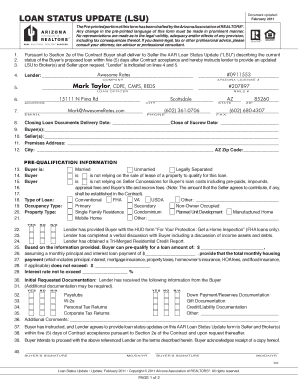

- In the top section, enter the lender's information, including the name, company, license number, and contact details such as phone and email address.

- Fill in the closing loan documents delivery date and the close of escrow date.

- Identify the buyer and seller by providing their names as well as the premises address and city details.

- Indicate the buyer's marital status and whether they are relying on the sale or lease of a property to qualify for the loan.

- Specify the type of loan by checking the appropriate box (e.g., Conventional, FHA, VA, USDA, Other).

- Select the occupancy type, either primary, secondary, or non-owner occupied, along with the property type.

- Verify that the lender has provided the required HUD form for FHA loans and completed a verbal discussion about the buyer's financial situation.

- Indicate the pre-qualification amount along with the monthly payment that works for the buyer.

- List any requested documentation received and check off items accordingly (e.g., pay stubs, W-2s, tax returns).

- Provide additional comments if necessary, then ensure the buyer provides their signature and date.

- Complete the documentation section by confirming the lender's actions, including examination of contracts, initial disclosures, and submission to underwriting.

- Finalize the form by checking off major closing tasks completed by the lender.

- Once all sections are completed, save your changes, and download or print the document for sharing as needed.

Start completing your Loan Call Questionnaire for Status of Loan online today!

If you have very good to excellent credit, getting a quick approval over the phone shouldn't be a problem. However, if your credit is less than perfect, it will probably be necessary to meet with a finance manager at a dealership in order to be approved for financing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.