Loading

Get Interim Report And Answer Of Garnishee

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Interim Report And Answer Of Garnishee online

This guide provides a comprehensive overview of how to complete the Interim Report And Answer Of Garnishee online. Whether you have experience with legal forms or are entirely new to the process, these clear steps will help you fill out the required information accurately and efficiently.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to access the Interim Report And Answer Of Garnishee, allowing you to fill it out in an online format.

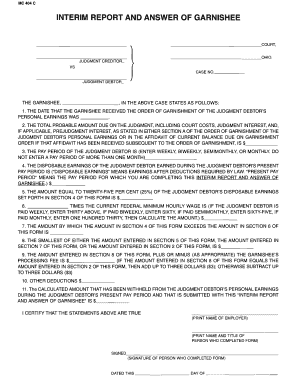

- Enter the name of the court at the top of the form. This information is crucial as it identifies the jurisdiction handling the case.

- Fill in the names of the judgment creditor and judgment debtor along with the case number. It's essential to ensure accuracy in these details.

- In the first section, indicate the date the garnishee received the order of garnishment concerning the judgment debtor's personal earnings.

- Provide the total probable amount due on the judgment, which should include all applicable court costs and interest. This information is either found in the order of garnishment or the affidavit that may have been received later.

- Specify the pay period of the judgment debtor, ensuring that you select from the options: weekly, biweekly, semimonthly, or monthly.

- Calculate and state the disposable earnings earned during the present pay period, which are the earnings after all legally required deductions.

- Calculate 25% of the disposable earnings listed in the previous step and record that amount.

- Determine the current federal minimum hourly wage multiplied by either thirty, sixty, sixty-five, or one hundred thirty depending on the payment schedule of the judgment debtor.

- Fill in the amount by which the disposable earnings exceed the calculation of the minimum wage as calculated in the previous step.

- Identify the smallest figure from the amounts calculated in the previous sections: the 25% amount, the disposable earnings, or the total due on the judgment.

- Calculate the amount to report, adding or subtracting the garnishee's processing fee of up to three dollars from the number determined in the previous step.

- List any other deductions applicable to the judgment debtor.

- Finally, provide the total calculated amount withheld from the debtor's earnings and submit this report. Ensure to validate the accuracy of the information provided.

Complete your Interim Report And Answer Of Garnishee online today!

Affidavit for continuing garnishment is a sworn statement by a plaintiff or his/her attorney or agent requesting the issuance of a summons of continuing garnishment as the defendant is indebted to the plaintiff on a judgment from a particular court and the plaintiff believes that the garnishee is or may be an employer ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.