Loading

Get Csjfinance

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Csjfinance online

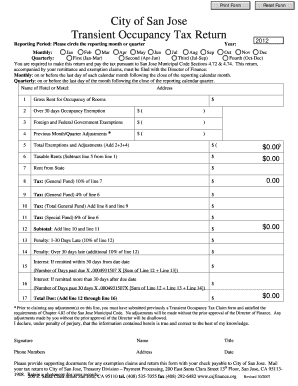

This guide provides clear and supportive instructions on how to effectively fill out the Csjfinance form for the transient occupancy tax return. Following these steps will help ensure that you complete the form accurately and submit it on time.

Follow the steps to complete your transient occupancy tax return.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Select the reporting period by circling the appropriate month or quarter and entering the corresponding year at the top of the form. Ensure to indicate whether this is a monthly or quarterly return.

- Complete the section for 'Name of Hotel or Motel' and 'Address'. This information is crucial for identifying the property for which the tax is being reported.

- Fill in the 'Gross Rent for Occupancy of Rooms' to detail the total rental income earned during the reporting period.

- If applicable, enter amounts for any exemptions under 'Over 30 days Occupancy Exemption' and 'Foreign and Federal Government Exemptions'. Make sure these are accurately entered as they will affect your total taxable amount.

- Complete the 'Previous Month/Quarter Adjustments' if you have any adjustments to declare from a previously submitted return.

- Calculate the 'Total Exemptions and Adjustments' by adding the values entered in steps 5 and 6.

- Determine 'Taxable Rents' by subtracting the total exemptions and adjustments from the gross rent reported in step 4.

- Fill in the rent received from the state, if applicable.

- Calculate the taxes due for the general fund, which include a 10% tax on line 7 (rent from state) and a 4% tax on line 6 (taxable rents). Add these amounts together for the total general fund tax.

- Calculate 'Tax (Special Fund)' as 6% of the taxable rents reported.

- Combine the total general fund tax and the special fund tax to determine the subtotal.

- If applicable, calculate any penalties for late filing based on the number of days overdue.

- If remitting payment later than 30 days past the due date, compute any additional interest or penalties as necessary.

- Add all calculations from lines 12 through 16 to arrive at the 'Total Due'.

- Sign and date the form. Ensure to include your name, title, and contact number for any follow-up.

- Submit the completed form and any supporting documents for exemption claims to the designated address. Choose to save changes, download, print, or share the form as needed.

Complete your transient occupancy tax return online today for a seamless submission experience.

Related links form

What is the sales tax rate in San Jose, California? The minimum combined 2023 sales tax rate for San Jose, California is 9.38%. This is the total of state, county and city sales tax rates.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.