Loading

Get Third Party Authorization Form - Roundpoint Mortgage Servicing

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Third Party Authorization Form - RoundPoint Mortgage Servicing online

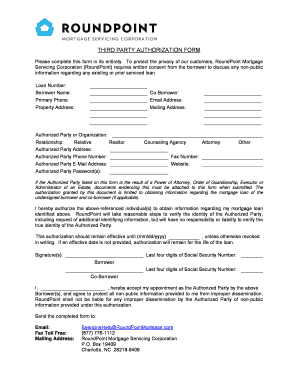

Filling out the Third Party Authorization Form is a vital process for granting permission to discuss your mortgage loan details with authorized individuals. This guide will help you navigate the form efficiently and ensure that all necessary information is provided accurately.

Follow the steps to complete the form online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the designated editor.

- Enter the loan number in the designated field. This is vital to identify the correct mortgage account.

- Fill in the borrower’s full name as it appears on the mortgage documents.

- Provide the primary phone number of the borrower for contact purposes.

- Input the property address associated with the mortgage.

- If applicable, provide the co-borrower's information by entering their full name.

- List the co-borrower's email address if different from the primary borrower.

- Complete the mailing address for the borrower and co-borrower as necessary.

- Specify the authorized party or organization’s name who is receiving access to the information.

- Indicate the relationship of the authorized party to the borrower (e.g., relative, realtor).

- Fill in the authorized party’s address, phone number, and email address.

- If applicable, include any necessary password(s) for the authorized party.

- Check the appropriate box for the type of authorized party, such as counseling agency or attorney.

- Attach any required documentation if the authorized party is a result of legal authority.

- Sign and date the form at the bottom, including the last four digits of the social security numbers for both the borrower and co-borrower.

- The authorized party must accept their appointment by signing their name on the designated line.

- Review the completed form for accuracy before submitting.

- Send the completed form to the provided email, fax, or mailing address as outlined in the instructions.

Complete your documents online with confidence and ensure your mortgage details are handled securely.

"Third-party review required" means the homeowner has not sought approval yet from his/her lender to do a short sale or approval is pending review of the homeowner's application. ... Plus there is a risk that the homeowner will not qualify for a short sale in which case the property will need to be sold at a higher price.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.