Loading

Get In Kind Donation

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the In Kind Donation online

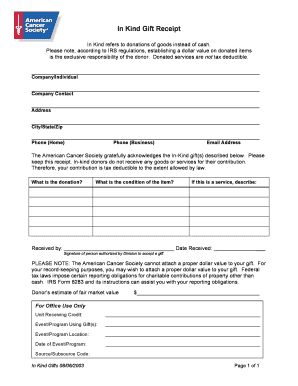

Filling out the In Kind Donation form is an essential step for individuals and organizations looking to make a generous contribution in the form of goods or services. This guide offers clear instructions on how to accurately complete the form to ensure proper documentation and compliance with regulations.

Follow the steps to successfully complete your In Kind Donation form.

- Press the ‘Get Form’ button to obtain the In Kind Donation form and open it for editing.

- Begin by entering your company or individual name in the designated field. This identifies who is making the donation.

- Next, provide the company contact information, including the address, city, state, and zip code. This information is important for identification and communication.

- Fill in the phone number fields. Include both the home and business numbers to ensure that the organization can reach you if needed.

- Provide your email address in the designated field to receive any relevant correspondence regarding your donation.

- In the section describing the donation, clearly state what items or services you are donating. Detail is essential for proper record-keeping.

- Indicate the condition of the item(s) being donated. This helps the organization evaluate and process your donation accurately.

- If the donation is a service, provide a detailed description of the service being offered to ensure clarity.

- The next section requires the name of the person receiving the gift and the date the donation was received. Ensure this is completed for records.

- Sign where indicated to show the authorization of the individual accepting the gift on behalf of the organization.

- Finally, estimate the fair market value of your donation in the designated space. While it is your responsibility to determine this value, it is crucial for your records.

- After completing the form, you can save your changes, download a copy, print it, or share it as needed.

Complete your In Kind Donation form online today to make a difference!

Gifts in kind are distinguished from gifts of cash or stock. Some types of gifts in kind are appropriate, but others are not. Examples of in-kind gifts include goods like food, clothing, medicines, furniture, office equipment, and building materials.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.