Loading

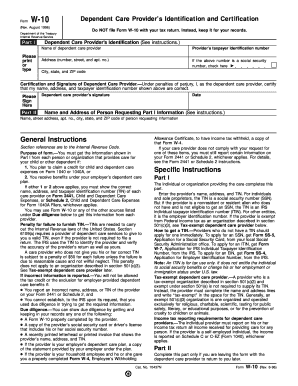

Get August 1996) Do Not File Form W-10 With Your Tax Return - Monroecounty

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the August 1996 Do NOT File Form W-10 With Your Tax Return - Monroecounty online

Filling out Form W-10 can seem daunting, but with this guide, you will easily navigate each section. This form is essential for collecting the required information from your dependent care provider for tax purposes.

Follow the steps to successfully complete the Form W-10 online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- In Part I, provide the dependent care provider's identification information. This includes entering the name, taxpayer identification number, and address of the provider. If the taxpayer identification number is a Social Security number, check the appropriate box.

- Complete the certification section, where the dependent care provider must sign and date the form to confirm the accuracy of the information provided in Part I.

- In Part II, fill out the name and address of the person requesting the information from Part I. This is typically you, the user.

- Review all entries for accuracy and completeness, ensuring that no required fields are left blank.

- Once completed, save changes to your document, then download or print the form for your records, keeping in mind that you do not file it with your tax return.

Start filling out your Form W-10 online today to ensure you have all necessary information for your taxes.

Yes, you can still file taxes without a W-2 or 1099. Usually, if you work and want to file a tax return, you need Form W-2 or Form 1099, provided by your employer. If you did not receive these forms or misplaced them, you can ask your employer for a copy of these documents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.