Loading

Get Hootentx

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hootentx online

Filling out the Hootentx online is a straightforward process that ensures accurate tax preparation. This guide provides you with step-by-step instructions to help you complete the form efficiently.

Follow the steps to complete the Hootentx form accurately.

- Click the ‘Get Form’ button to access the Hootentx form and open it in your selected editor.

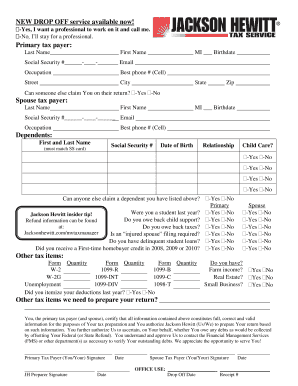

- Begin by providing the primary taxpayer's last name, first name, middle initial, birthdate, social security number, email, occupation, and best phone number. Ensure that all details are accurate and complete.

- Fill in the primary taxpayer's address, including street, city, state, and zip code.

- Indicate whether someone else can claim you on their return by selecting 'Yes' or 'No'.

- Repeat the process for the spouse taxpayer section, entering their last name, first name, middle initial, birthdate, social security number, email, occupation, and best phone number.

- List any dependents by providing their first and last names, social security numbers (ensure they match the SS card), dates of birth, relationships, and whether child care expenses are applicable. For each dependent, select 'Yes' or 'No' accordingly.

- Confirm whether anyone else can claim a dependent you have listed above by selecting 'Yes' or 'No'.

- Complete the section on student status for the previous year by indicating 'Yes' or 'No'.

- Answer the questions regarding back child support, taxes owed, delinquent student loans, and any first-time homebuyer credit received in 2008, 2009, or 2010.

- List any additional tax items such as W-2 forms, 1099-R forms, and their respective quantities.

- Indicate whether you itemized deductions in the previous year and answer questions about farm income, real estate, or small businesses.

- Review the certification statement to ensure all provided information is correct and valid, then authorize Jackson Hewitt to prepare your tax return based on this information.

- Sign and date the form for both the primary taxpayer and spouse. Ensure that all signatures are present.

- Finally, save your changes, download the completed form, or print it for your records. You may also share it if needed.

Start filling out your Hootentx form online today!

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.