Loading

Get Agric Vijana

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Agric Vijana online

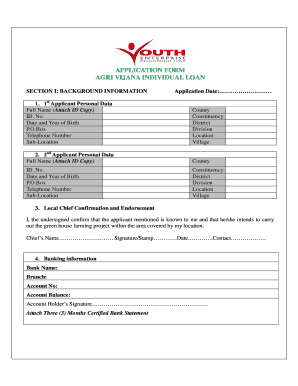

Filling out the Agric Vijana Individual Loan application is an essential step for individuals seeking to secure funding for greenhouse farming projects. This guide provides a clear and supportive approach to help you navigate through each section of the form with confidence.

Follow the steps to successfully complete your application

- Click the ‘Get Form’ button to access the Agric Vijana form and open it in your selected document editor.

- In the Background Information section, fill out the application date and provide the personal data for the first applicant. Include full name, identification number, date of birth, P.O. Box, telephone number, and location details such as county, constituency, district, division, sub-location, and village. Ensure you attach a copy of your identification.

- Repeat step 2 for the second applicant if applicable, ensuring that all personal details are accurately entered and necessary identification is attached.

- In the Local Chief Confirmation and Endorsement section, have your local chief sign and stamp the form, confirming their knowledge of your intentions to undertake a greenhouse project within their jurisdiction.

- Fill out the Banking Information section, providing your bank name, branch, account number, account balance, and your signature. Attach three months of certified bank statements as proof of financial status.

- In the Prior Farming/Agricultural Experience section, detail your previous agricultural activities, achievements, and other sources of income if applicable. If you are salaried or have a business, include relevant documentation.

- Describe the proposed project location, including a map. Provide detailed information about the district, location, sub-location, village, and proximity to landmarks like schools or hospitals.

- In the Loan Proposal section, specify the loan amount requested and proposed business details. Indicate your preferred crops, main customers, target market, and reasons for selecting these crops.

- Complete the Business Cycle section by detailing product information, expected sales timelines, and pricing. Ensure that the projected income flow from the business is outlined, including total costs and expected profit.

- Fill out the Project Management details, including the proposed farm champion's name and contact information, and their reasons for nomination.

- Complete sections on Marketing strategies, proposed growth plans, and the loan repayment plan.

- Proceed to the Loan Agreement section, ensuring that both applicants sign and date where indicated, confirming the accuracy of the provided information.

- In the Loan Security/Collateral section, provide a list of items being offered as security, ensuring all details are accurate and the total liquidation value is calculated.

- After filling out all sections, review your form for accuracy. Save any changes made to the document. You may proceed to download, print, or share the completed form as required.

Take the next step towards achieving your agricultural goals by completing your application online today.

What are NHBC Standards? The NHBC Standards define the technical requirements and performance standards for the design and construction of new homes registered with us and provide guidance on how these can be achieved.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.