Loading

Get Form 3150

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 3150 online

Filling out the Form 3150 online is essential for Idaho-based IFTA licensees to report and pay their fuel tax accurately. This guide provides clear, step-by-step instructions to help you navigate the form effectively.

Follow the steps to complete the Form 3150 online successfully.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

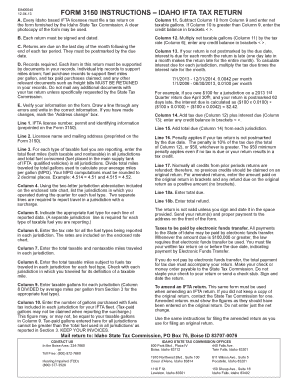

- Begin by confirming your IFTA license number, which is preprinted on Form 3150 in Line 1. Ensure all information is accurate and current.

- In Line 2, enter the licensee name and mailing address, which should also be prefilled on the form. Review this information for correctness.

- Fill out Line 3 by entering the total fleet miles and total fuel consumed for each type of taxable fuel you are reporting. Calculate your average miles per gallon, rounding to two decimal places as needed.

- For Column 4, list the jurisdictions where you operated, using the two-letter abbreviation provided in the enclosed rate chart. Make sure to enter each jurisdiction on a separate line if applicable.

- In Column 5, indicate the appropriate fuel type for the information reported in the corresponding rows. Separate jurisdiction lines are required for different fuel types.

- Calculate the net taxable gallons in Column 11 by subtracting Column 10 from Column 9. Enter any credit balances in brackets when applicable.

- Multiply the net taxable gallons (Column 11) by the tax rate (Column 6) for Column 12, and format any credit balance accordingly.

- Fill in Column 13 to account for late fees if your return is postmarked after the due date, allocating the appropriate interest for each jurisdiction as described in the instructions.

- In Column 14, add the amount from Column 12 to any interest due from Column 13. Be sure to include any credit balance as needed.

- Complete Line 15 by totaling the amounts due from each jurisdiction.

- Consider Line 16, where a penalty may apply for late submissions. Calculate 10% of the tax due or a $50 minimum penalty, according to the guidelines provided.

- If amending a return, use Line 17 to report the credits appropriately, and Line 18a for total amounts due, while noting total refunds in Line 18b if applicable.

- Before submitting, sign and date the return in the provided space. It is crucial for the validity of the form.

- After completing the form, you can save your changes, download it for your records, print the completed form, or share it as necessary.

Complete your Form 3150 online today to ensure accurate tax reporting!

DD Form 3150, "Contractor Personnel and Visitor Certification of Vaccination"

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.