Loading

Get Uc 2a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Uc 2a online

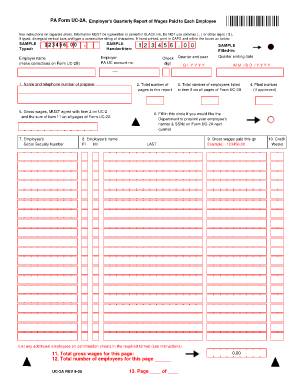

The Uc 2a form, also known as the Employer's Quarterly Report of Wages Paid to Each Employee, is an essential document for employers to report wages for each employee. This guide provides detailed and clear instructions on how to accurately complete the Uc 2a online, ensuring compliance with reporting requirements.

Follow the steps to fill out the Uc 2a online effectively.

- Press the ‘Get Form’ button to access and open the Uc 2a form in your document editor.

- Begin with entering the employer information. You will need to provide your PA UC account number and your employer name. If there are any corrections needed, you will have to enter them on Form UC-2B.

- Fill in the name and telephone number of the preparer in the specified fields. This should be someone who is authorized to manage the reporting process.

- Indicate the total number of pages in this report to ensure all information is accounted for.

- Record the gross wages on this form. Make sure to agree this total with item 2 on Form UC-2 and the sum of item 11 across all pages of Form UC-2A.

- Specify the quarter and year for which you are reporting. Make sure to fill out the quarter-ending date in MM/DD/YYYY format.

- Enter the total number of employees listed in item 8 across all pages of Form UC-2A.

- If applicable, include the plant number, but only if it has been approved.

- If you wish for the Department to preprint your employees' names and social security numbers on the next quarter’s Form UC-2A, fill in the designated circle.

- For each employee, fill in their Social Security Number in the respective field.

- Next, provide each employee’s full name, ensuring to use their first name, middle initial, and last name.

- Enter the gross wages paid to each employee for the quarter, formatted correctly without commas or dollar signs.

- If necessary, continue listing any additional employees on continuation sheets as per the required format.

- Calculate and enter the total gross wages for this page in the appropriate section of the form.

- Finally, state the total number of employees for this specific page before finalizing your report. Make sure to also indicate the page number and total pages at the bottom.

Complete your Uc 2a form online today for accurate wage reporting.

The taxable wage base is $10,000 per employee per calendar year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.