Loading

Get New Account Application - City Of Cincinnati - Cincinnati-oh

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the New Account Application - City Of Cincinnati - Cincinnati-oh online

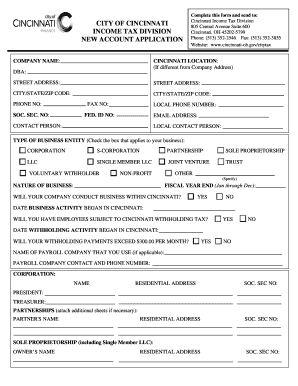

Filling out the New Account Application for the City of Cincinnati is a straightforward process that can be completed online. This guide will provide you with step-by-step instructions to ensure that your application is completed accurately and efficiently.

Follow the steps to complete your application online.

- Click ‘Get Form’ button to obtain the form and open it in your browser.

- Begin by entering the company name in the designated field. Ensure that this reflects the official name of your business.

- Provide the Cincinnati location if it differs from the company address. Fill in the DBA (Doing Business As) name if applicable.

- Complete the street address, city, state, and zip code fields accurately to ensure proper identification of your business location.

- Fill in the primary phone number, fax number, and any local phone numbers associated with the business.

- Enter the federal identification number and email address of the business. This will aid in communication regarding your application.

- Identify a contact person for your business and, if different, a local contact person who can answer any questions related to the application.

- Select the appropriate type of business entity by checking the corresponding box from the available options. Examples include Corporation, Sole Proprietorship, LLC, etc.

- Specify the nature of your business, providing a brief description that outlines its primary activities.

- Indicate your fiscal year-end (from January through December) in the provided field.

- Answer whether your company will conduct business within Cincinnati and whether you will have employees subject to Cincinnati withholding tax.

- If applicable, provide the date that business activity began in Cincinnati. Additionally, include the start date for withholding activity.

- Indicate if your withholding payments are expected to exceed $300.00 per month.

- If your business utilizes a payroll company, provide their name and contact phone number.

- Complete the sections for the corporation, partnerships, or sole proprietorship, filling in names, residential addresses, and social security numbers as required.

- Once all fields are accurately filled, review your application for any errors or omissions before submission.

- Upon review, save the changes made to the application. You may download, print, or share the completed form as necessary.

Begin your application online today to comply with Cincinnati's income tax requirements.

Previously, it cost a new business $125 to register with the state, and approval typically took as long as four days. An expedited one-day filing cost $225. Effective Thursday, the filing fee dropped to $99, and registration is completed the same day.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.