Loading

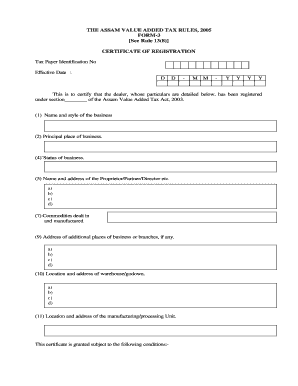

Get The Assam Value Added Tax Rules 2005 Form 3 See Rule 13 8 Certificate Of Registration

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Assam Value Added Tax Rules 2005 Form 3 Certificate Of Registration online

Filling out the Assam Value Added Tax Rules 2005 Form 3, also referred to as the Certificate of Registration, is an essential process for businesses seeking to comply with state regulations. This guide offers straightforward steps to assist you in completing the form online with clarity and confidence.

Follow the steps to successfully complete your registration certificate form online.

- Click the ‘Get Form’ button to obtain the form and open it for editing.

- Provide the 'Tax Payer Identification No' in the designated field to ensure proper identification.

- Enter the 'Effective Date' in the format DD-MM-YYYY, ensuring accuracy to validate your registration period.

- Fill in the 'Name and style of the business' section with the official name under which your business operates.

- Specify the 'Principal place of business' where your business's primary operations take place.

- Indicate the 'Status of business' by selecting the relevant option that describes your business structure.

- Complete the 'Name and address of the Proprietor/Partner/Director' fields, providing all relevant details.

- List the 'Commodities dealt in and manufactured' to clarify the nature of your business activities.

- If applicable, include the 'Address of additional places of business or branches,' noting each one clearly.

- Provide the 'Location and address of warehouse/godown' focusing on accurate geographic details.

- Include the 'Location and address of the manufacturing/processing Unit' if your business involves production.

- Review all filled fields for correctness and completeness before proceeding to the finalization step.

- Once all sections are complete, you can save changes, download, print, or share the certificate as required.

Start filling out your Assam Value Added Tax Rules 2005 Form 3 online today to ensure compliance with local regulations.

How to get a VAT refund Typically, you have to pay the value-added tax at the time of purchase, and then apply for a refund from the shop. Usually, your purchase must be over a certain amount in order to qualify for a VAT refund. ... Spending on food and hotels often isn't eligible for VAT refunds.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.