Loading

Get Form 314 Mvat

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 314 Mvat online

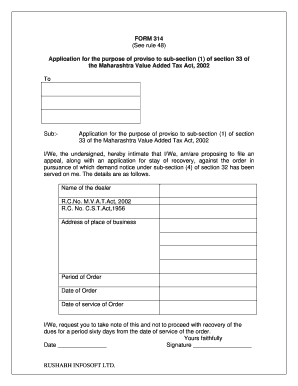

Filling out Form 314 Mvat online is an essential process for individuals appealing against an order under the Maharashtra Value Added Tax Act, 2002. This guide will provide a comprehensive overview of each section and field within the form, ensuring a smooth experience for users with varying levels of experience.

Follow the steps to complete the form accurately.

- Click 'Get Form' button to obtain the form and access it in the editor.

- Enter the name of the dealer in the appropriate field. This is typically the business name or the name of the individual making the application.

- Fill in the R.C. Number under the Maharashtra Value Added Tax Act, 2002. This number is essential for identifying your business registration.

- Input the R.C. Number under the Central Sales Tax Act, 1956 if applicable. This information helps to establish your tax compliance history.

- Provide the address of the place of business. Ensure this is accurate, as it will be used for correspondence.

- Specify the period of the order. This indicates the time frame relevant to the appeal you are addressing.

- Enter the date of the order. This is crucial as it relates to the timelines of your appeal.

- Indicate the date of service of the order. Make sure this date aligns with the documentation you received.

- In the request section, indicate your appeal intention and request the halt of recovery for sixty days from the date of service of the order.

- Complete the date and signature fields to validate your application. Make sure to sign in the designated space.

- Once you have filled out all the sections, review the information for accuracy. You can then choose to save changes, download, print, or share the completed form as necessary.

Begin your document submission process by completing forms online today.

An Act to consolidate and amend the laws relating to the levy and collection of tax on the sale or purchase of certain goods in the State of Maharashtra. . (2) It extends to the whole of the State of Maharashtra. 2[(3) It shall come into force on the 1st April 2005.]

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.