Loading

Get Ia 1065 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ia 1065 Form online

Filling out the Ia 1065 Form online can be a straightforward process if you follow the right steps. This guide will provide clear instructions to help you complete the Partnership Return of Income effectively.

Follow the steps to fill out the Ia 1065 Form online.

- Click ‘Get Form’ button to obtain the form and open it in your browser.

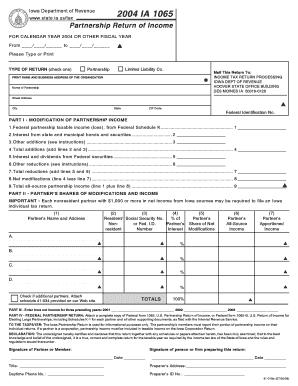

- Begin by identifying the type of return you are filing. Check one of the boxes for Partnership or Limited Liability Company.

- Fill in the name and business address of the organization. Ensure to provide the street address, city, state, and ZIP code accurately.

- Enter the federal identification number for the partnership, which is required for processing.

- Move on to Part I, where you will need to report modifications to partnership income. Input federal partnership taxable income from Federal Schedule K in line 1.

- Complete lines 2 to 8 by adding any interest from state and municipal bonds, other additions, reductions, and calculate net modifications.

- In Part II, list each partner's name, address, and their respective shares of modifications and income. Ensure that you include nonresident partners if applicable.

- In Part III, provide Iowa net income for the three preceding years, ensuring accuracy in reporting.

- Proceed to attach a complete copy of the federal form 1065 and any other necessary schedules to the form as required.

- Sign and date the declaration section of the form, indicating that the return is accurate and complete.

- Once all sections are filled out, save your changes, and you will have options to download, print, or share the completed form online.

Complete your documents online today for a smooth filing experience.

If the LLC is a partnership, normal partnership tax rules will apply to the LLC and it should file a Form 1065, U.S. Return of Partnership Income. Each owner should show their pro-rata share of partnership income, credits and deductions on Schedule K-1 (1065), Partner's Share of Income, Deductions, Credits, etc.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.