Loading

Get Cert 141 Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cert 141 Fillable online

Filling out the Cert 141 Fillable is an essential step for contractors seeking tax exemptions on materials and supplies used for projects with exempt entities. This guide provides clear instructions to ensure that your form is completed accurately and effectively.

Follow the steps to successfully complete the Cert 141 Fillable form online.

- Press the ‘Get Form’ button to acquire the Cert 141 Fillable, opening it in your digital editor of choice.

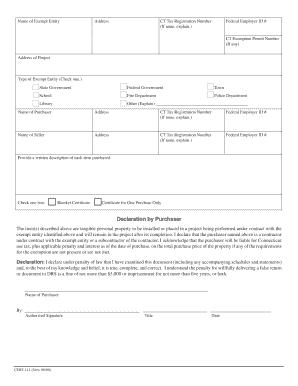

- Start by entering the name of the exempt entity in the designated field. This includes government bodies, schools, libraries, or other qualifying organizations.

- Provide the address of the exempt entity along with the CT tax registration number. If there is no registration number, please include a brief explanation.

- Fill in the federal employer ID number, if applicable, along with the address of the project where the materials will be installed.

- Select the type of exempt entity by checking the appropriate box, such as State Government, Federal Government, or others as outlined.

- Input the name and address of the purchaser, including their CT tax registration number and federal employer ID number.

- Next, enter the seller’s name and address, including the CT tax registration number and federal employer ID number.

- Provide a written description of each item being purchased. Make sure to detail what materials or supplies are relevant.

- Indicate whether this is a blanket certificate or for one purchase only by checking the respective box.

- Complete the declaration section by verifying that the items will be permanently installed under contract with the exempt entity and acknowledge liability for any tax due if conditions aren't met.

- Sign and date the form, ensuring the name of the purchaser and authorized signature are included.

- Once completed, save changes to the document as needed. You may also download, print, or share the form directly from the digital editor.

Complete your Cert 141 Fillable form online to ensure your tax exemption is processed smoothly.

Go to myconneCT, under Business Registration, click New Business/Need a CT Registration Number? There is a $100 fee for registering to collect sales and use tax. After registering, you will receive a Sales and Use Tax Permit that should be displayed conspicuously for your customers to see.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.