Loading

Get Report Of Property Presumed Unclaimed - Montana - Revenue Mt

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Report Of Property Presumed Unclaimed - Montana - Revenue Mt online

Filling out the Report Of Property Presumed Unclaimed - Montana - Revenue Mt is a straightforward process that requires careful attention to detail. This guide is designed to help you navigate the form step-by-step, ensuring you provide all necessary information correctly.

Follow the steps to successfully complete your report online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

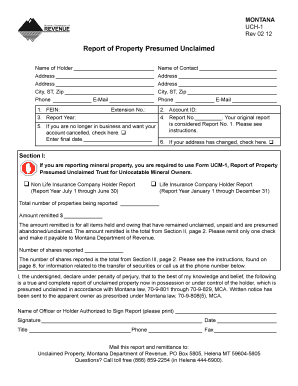

- Start by entering the Name of Holder and Address. Provide a complete address, including city, state, and zip code, along with a valid phone number and email address.

- Enter your Federal Employer Identification Number (FEIN) and the Report Year applicable for this report.

- Fill in the Name of Contact with their corresponding Address, Phone number, and Email address.

- Complete the Account ID and Report No. If your report number is your first submission, it should be marked as Report No. 1.

- Check the box if you are no longer in business and wish to cancel your account, also include the date of cessation.

- In Section I, indicate whether you are reporting as a Non-Life Insurance Company Holder or Life Insurance Company Holder by checking the appropriate box.

- Provide the total number of properties being reported and the total amount remitted for all items presumed unclaimed.

- Continue to Section II and Section III to provide detailed information about each individual property, including type codes, last transaction dates, amounts due, owners' names in alphabetical order, and last known mailing addresses.

- Review all entered information for accuracy. Once confirmed, you can save your changes, download, print, or share the completed report.

Complete your Report of Property Presumed Unclaimed online today.

Montana requires holders to send due diligence notifications for any property with a value of $50 or more. Holders must send due diligence letters each reporting cycle to the apparent owner at his or her last known address, not more than 120 days or less than 60 days prior to filing the report.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.