Loading

Get Vehicle Tax Invoice Request Form - Commonwealth Bank Of Australia - Commbank Com

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vehicle Tax Invoice Request Form - Commonwealth Bank Of Australia - Commbank Com online

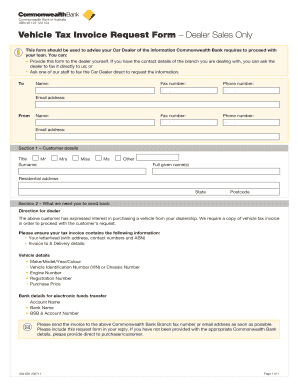

Filling out the Vehicle Tax Invoice Request Form is an essential step in facilitating your vehicle loan with the Commonwealth Bank of Australia. This guide will provide you with comprehensive instructions for completing the form accurately and effectively.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your contact details in the 'To' section, including your name, fax number, phone number, and email address. Ensure that all information is accurate and clearly formatted.

- In the 'From' section, provide the contact information of the person or representative sending the form. Include their name, fax number, phone number, and email address.

- Proceed to Section 1, labeled 'Customer Details'. Fill out the title, surname, and full given names of the customer. Make sure to include the residential address along with the corresponding state and postcode.

- Next, move to Section 2, titled 'What we need you to send back'. Clearly indicate the direction for the dealer to submit a vehicle tax invoice. Specify that it should include essential details such as the dealership's letterhead and all vehicle information.

- List the required vehicle details, including make, model, year, color, VIN or chassis number, engine number, registration number, and purchase price clearly.

- Provide the bank details needed for electronic funds transfer, which includes account name, bank name, BSB, and account number.

- Finalise the form by ensuring that you request the dealer to send the invoice back to the Commonwealth Bank's designated fax number or email address provided above. Confirm that the request form is included in their response.

- After completing the form, review all entries for correctness. Finally, save changes, download, print, or share the form as needed.

Complete your Vehicle Tax Invoice Request Form online today to streamline your vehicle loan process.

There's a difference between receipts and tax invoices. A receipt is a document that shows proof of purchase, and allows you to return damaged or faulty goods to the business selling it. A tax invoice is a document shows the price of a purchase, as well as whether GST was collected.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.