Loading

Get Annual Employer Withholding Reconciliation Report

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ANNUAL EMPLOYER WITHHOLDING RECONCILIATION REPORT online

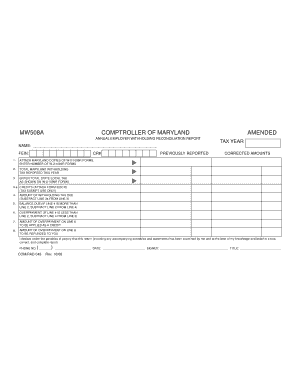

The Annual Employer Withholding Reconciliation Report is an essential document for Maryland employers to report annual withholding tax information. This guide provides a clear and detailed process to complete the report online effectively.

Follow the steps to complete your report accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by filling in your name and the CR number in the designated fields at the top of the form.

- Attach copies of Maryland W-2/1099R forms as required, ensuring to enter the total number of forms attached.

- Report the total Maryland withholding tax that has been reported for the tax year in the designated area.

- Enter the total state/local tax amounts as shown on your W-2/1099R forms in the corresponding field.

- If applicable, complete the credits section by attaching Form 500CR for tax-exempt use and reporting the amounts.

- Indicate the amount of withholding tax due by subtracting line 3a from line 3 following the instructions provided.

- Calculate the balance due by subtracting line 2 from line 4 if line 4 exceeds line 2, and document this amount.

- Determine any overpayment by subtracting line 4 from line 2 if line 4 is less than line 2.

- If you’ve identified overpayment, indicate how much of the overpayment you would like to apply as a credit and how much will be refunded.

- Complete the declaration statement confirming the accuracy of your report, providing your phone number, date, and signature in the fields provided.

- Once all sections are completed, review your entries for accuracy, then save your changes, and choose to download, print, or share the report as needed.

Complete your Annual Employer Withholding Reconciliation Report online today to ensure compliance and accurate reporting.

The PA-501 is a deposit statement used to make a payment and to insure it is properly applied to your employer withholding account. The PA-W3 is used to reconcile the employer withholding activities...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.