Loading

Get Form 200 F

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 200 F online

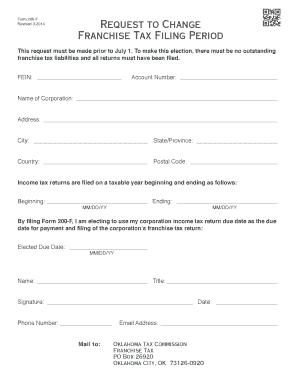

Filling out Form 200 F is an important step for users seeking to change their franchise tax filing period. This guide will take you through the process step-by-step, ensuring that you can complete the form accurately and efficiently.

Follow the steps to complete your Form 200 F online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Federal Employer Identification Number (FEIN) in the designated field.

- Provide your account number in the appropriate section.

- Fill in the name of your corporation. Ensure that it matches the legal name on your documents.

- Input the official address of your corporation, including the city, state or province, country, and postal code.

- Indicate the beginning date and ending date for your taxable year in MM/DD/YY format.

- Select the elected due date for your corporation’s franchise tax return. This should reflect the new due date you wish to set.

- Complete the name and title fields of the person responsible for the submission. This might be an officer or authorized representative.

- Provide the signature of the individual listed in the previous step, along with the date of signing and their phone number and email address.

- Once all fields are completed and reviewed for accuracy, save your changes. You can choose to download, print, or share the form as needed.

Take the first step in managing your franchise tax records effectively by filling out and submitting your Form 200 F online today.

Every corporation organized under the laws of this state, or qualified to do or doing business in Oklahoma in a corporate or organized capacity by virtue or creation of organization under the laws of this state or any other state, territory, district, or a foreign country, including associations, joint stock companies ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.