Loading

Get Form 106 - Freddie Mac

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 106 - Freddie Mac online

This guide provides a thorough walkthrough for users on completing Form 106 - Freddie Mac online. Whether you are new to this process or require a refresher, these step-by-step instructions will help you fill out the form accurately and efficiently.

Follow the steps to complete the Form 106 - Freddie Mac online.

- Press the ‘Get Form’ button to access the form and open it in the required editor.

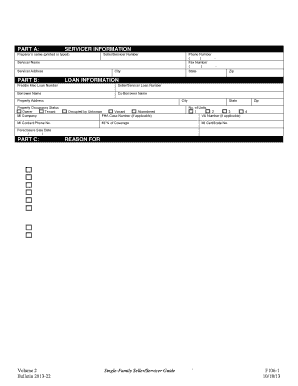

- In Part A, provide the servicer information by filling in the preparer’s name, seller/servicer number, phone number, fax number, state, servicer name, and servicer address.

- In Part B, enter the loan information, including the Freddie Mac loan number, seller/servicer loan number, borrower name, co-borrower name, and property address. Further specify the property occupancy status by selecting the appropriate options.

- Still in Part B, include the MI company and related details, such as the FHA case number, MI contact phone number, MI percentage of coverage, foreclosure sale date, number of units, VA number (if applicable), and MI certificate number.

- Move to Part C, where you will indicate the reason for the rollback request by marking the relevant box(es). Specify the loan status you are requesting following the rollback, and include any follow-up information if applicable.

- In Part D, fill in any additional information related to bankruptcy, reinstatement, or redemption actions if applicable. Provide details such as bankruptcy chapter, date filed, attorney’s name and contact information, and reinstatement dates.

- Finally, in Part E, use the additional comments section to include any relevant details that have not been previously documented in the form, ensuring all information needed for the request is present.

- After completing the form, you can save changes, download, print, or share the document as necessary.

Complete your Form 106 - Freddie Mac online today for a smooth and efficient process.

For a Caution Mortgage, the Caution Risk Class indicates that the Mortgage is unlikely to comply with Freddie Mac's eligibility and underwriting requirements because there is a strong indication of excessive layering of risk as described in Section 5102.2.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.