Loading

Get Oregon Lb50

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Oregon Lb50 online

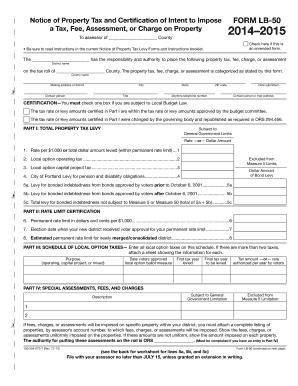

Filling out the Oregon Lb50 form accurately is essential for property tax certification in Oregon. This guide will provide you with clear and supportive instructions to help you complete this form online, ensuring you meet all necessary requirements.

Follow the steps to accurately complete the Oregon Lb50 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the district that has the authority to place the property tax on the tax roll of the specified county. Ensure to write the full name clearly.

- Fill in the mailing address, including the city, state, and ZIP code for the district. This information must be accurate to ensure proper communication.

- Provide the contact person's name, title, and daytime telephone number. This contact should be able to answer any questions related to the form.

- Indicate the date you are submitting the form, which helps in tracking and verifying the submission.

- In the certification section, check the appropriate box to confirm whether the tax rate or levy amounts are within the approved limits or were changed and republished.

- In Part I, provide the total property tax levy information. Specify the rate per $1,000 and any local option taxes indicated in the appropriate fields.

- Complete Part II by certifying the permanent rate limit and the election date when your district received voter approval.

- For Part III, list all local option taxes, including the purpose, approval dates, first and final tax years, and the tax amount or rate authorized.

- Fill out Part IV for special assessments, fees, and charges, including a complete listing of properties if applicable. Be sure to specify amounts uniformly imposed or individual amounts.

- Before finalizing, review all entries for accuracy and completeness, checking against the guidelines provided in the instructions booklet.

- Once all fields are filled out, save your changes, and you can download, print, or share the completed form as needed.

Complete your forms online with confidence and ensure timely submissions!

The rate limits created by Measure 50 replace Oregon's traditional levy system, which used the real market value (RMV) to assess individual properties. Under Measure 50, the assessed value (AV) of your home may be less than its real market value and taxes will be limited by the 3% value growth cap.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.