Loading

Get Mileage Reimbursement Form Client To Client Or Distance

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mileage Reimbursement Form Client To Client Or Distance online

This guide aims to provide clear and comprehensive instructions for completing the Mileage Reimbursement Form Client To Client Or Distance online. Whether you are new to the process or seeking a refresher, this step-by-step approach will help ensure you fill out the form correctly and efficiently.

Follow the steps to complete your mileage reimbursement form accurately.

- Press the ‘Get Form’ button to access the Mileage Reimbursement Form and open it using your preferred online editor.

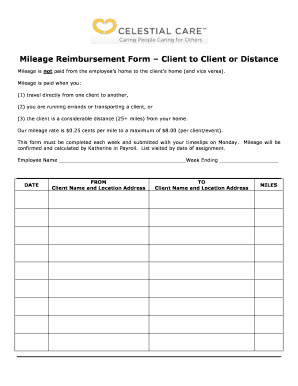

- Begin filling out your information in the 'Employee Name' field. Enter your full name as required.

- In the 'Week Ending' section, indicate the date for which you are submitting the mileage reimbursement, ensuring it aligns with your payroll schedule.

- Proceed to the 'DATE' column. Input the specific dates of travel related to each client visit.

- Next, in the 'FROM' section, enter the name and address of the client you are traveling from. Be precise to avoid confusion.

- In the 'TO' segment, provide the name and address of the client you are traveling to, again ensuring accuracy.

- Record the mileage traveled in the 'MILES' column. If you traveled from one client to another, calculate the distance accurately.

- After all fields have been filled out, review the information for accuracy and completeness. Adjust any fields as necessary.

- Once satisfied with the entry, save your changes. You may download, print, or share the completed form as required.

Complete your Mileage Reimbursement Form online today and ensure you receive your due compensation.

Employees that use their own car for business journeys can claim tax relief on the approved mileage rate. ... 45p per mile is the tax-free approved mileage allowance for the first 10,000 miles in the financial year it's 25p per mile thereafter.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.