Loading

Get Form No. 15g

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM NO. 15G online

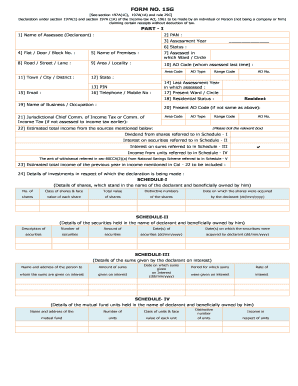

Filling out the FORM NO. 15G online is a straightforward process that allows individuals to claim certain receipts without the deduction of tax. This guide provides comprehensive and clear instructions to help users complete each section of the form with confidence.

Follow the steps to complete the FORM NO. 15G online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your name in the 'Name of Assessee (Declarant)' field. Ensure your name matches your official identification.

- Enter your Permanent Account Number (PAN) in the appropriate field. This unique identifier is essential for tax purposes.

- Select the assessment year for which you are filing the form from the drop-down list.

- Indicate your status in the 'Status' field, selecting the option that best describes your tax status.

- Fill in the details of your address, including flat/door/block number, name of the premises, road/street/lane, area/locality, town/city/district, and state.

- Provide the PIN code corresponding to your address.

- Enter your email address and telephone/mobile number to ensure the relevant authorities can contact you if needed.

- Indicate your residential status, selecting from options such as 'Resident' or 'Non-Resident.'

- Complete the section that asks for your estimated total income from relevant sources by ticking the appropriate boxes.

- Provide details of investments in respect of which the declaration is being made by filling out the specific schedules (I to V) as applicable.

- Review all completed sections for accuracy and completeness before finalizing your form.

- Sign the declaration, confirming that the information is correct and complete as of the date of filing.

- Save your changes, and download, print, or share the filled form as required.

Take action today and complete your FORM NO. 15G online efficiently!

Form 15G is a declaration that can be filled out by bank fixed deposit holders (individuals less than 60 years of age and HUF) to ensure that no TDS (tax deduction at source) is deducted from their interest income for the fiscal.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.