Loading

Get Schedule E Worksheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule E Worksheet online

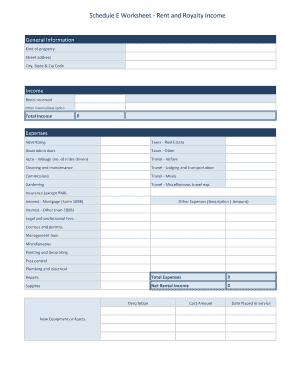

The Schedule E Worksheet is an essential tool for reporting rental and royalty income. This guide provides clear, step-by-step instructions on how to complete the worksheet online, ensuring that you have all the necessary information at your fingertips.

Follow the steps to fill out the Schedule E Worksheet effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide general information about the property by entering the kind of property, street address, city, state, and zip code.

- In the income section, list the rents received and other income along with a brief description to account for all sources of income.

- Calculate the total income by summing the rents received and any additional income listed.

- Move to the expenses section, where you will detail various expenses such as advertising, real estate taxes, association dues, and more. Ensure to include any necessary descriptions alongside the amounts.

- Include travel-related expenses such as airfare, lodging, meals, and miscellaneous travel expenses as applicable.

- Add all other allowable expenses, including insurance, legal fees, repair costs, and management fees, to provide a comprehensive record.

- Calculate the total expenses by summing all the individual costs listed.

- Determine your net rental income by subtracting the total expenses from the total income.

- For any new equipment or assets, fill in the cost amount and the date placed in service.

- After completing the worksheet, review all entries for accuracy and clarity. Users can then save changes, download, print, or share the form as necessary.

Start filling out the Schedule E Worksheet online today to ensure your rental and royalty income is accurately reported.

Related links form

Use Schedule E (Form 1040 or 1040-SR) to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. You can attach your own schedule(s) to report income or loss from any of these sources. Use the same format as on Schedule E.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.