Loading

Get Rp 467 Rnw

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rp 467 Rnw online

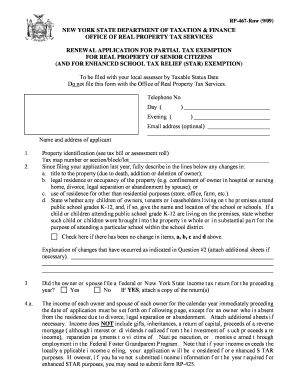

The Rp 467 Rnw is a renewal application for partial tax exemption available to eligible property owners, specifically targeting senior citizens. This guide provides clear and detailed instructions on how to complete the form online, ensuring that all necessary information is accurately submitted.

Follow the steps to successfully complete your application.

- Press the ‘Get Form’ button to retrieve the Rp 467 Rnw form and open it for editing.

- Begin by entering your name and address in the designated fields at the top of the form. Ensure all information is complete and accurate.

- Provide the property identification details, including the tax map number or the section/block/lot information, as found on your tax bill or assessment roll.

- If there have been changes in ownership, legal residence, or property use since your last application, describe them in the lines provided. You can attach additional sheets if necessary.

- Indicate whether you or your spouse filed a federal or New York State income tax return for the preceding year by checking 'Yes' or 'No'. If 'Yes', attach a copy of the return.

- List the income of each owner and their spouse for the calendar year immediately preceding the application date. Be specific about each source of income and the corresponding amounts.

- Calculate the subtotal of the income from all owners and spouses in the relevant section. Include any necessary proof of income.

- If applicable, indicate how much of the income was used for an owner’s care in a residential health care facility and provide necessary documentation.

- Complete the medical expense section if a deduction for unreimbursed medical and prescription drug expenses is authorized in your municipality. Attach proof of any expenses incurred.

- Sign the certification statement, confirming the truthfulness of the information provided. All owners listed must sign, and include the date of signing.

- After completing all sections, review the form for accuracy. You can now save your changes, download, print, or share the completed Rp 467 Rnw form as needed.

Complete your Rp 467 Rnw form online today to ensure you receive your property tax exemption!

income. Every person whose estimated tax liability for the year is ₹10,000 or more, is liable to pay advance tax. However, a senior citizen need not to pay any advance tax, provided he does not have any income under the head "Profits and Gains of Business or Profession".

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.