Loading

Get Uniform Borrower Assitance Form- (form 710); Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Uniform Borrower Assistance Form- (Form 710); PDF online

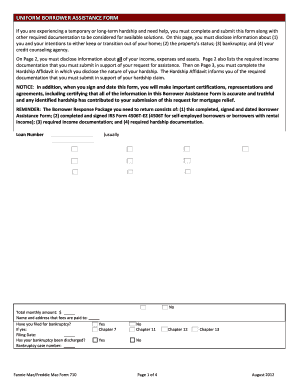

The Uniform Borrower Assistance Form (Form 710) is essential for individuals facing financial hardships seeking mortgage relief. This guide provides clear, step-by-step instructions for completing the form effectively online.

Follow the steps to complete the Uniform Borrower Assistance Form.

- Press the ‘Get Form’ button to access the form and open it in your preferred document editor.

- Begin by providing your loan number and the name of your loan servicer at the top of the form. Indicate your intention regarding the property by selecting one of the options: 'Keep the Property,' 'Vacate the Property,' or 'Sell the Property.'

- Specify the current status of the property, indicating whether it is your primary residence, a second home, or an investment property. Additionally, describe whether the property is owner-occupied, renter-occupied, or vacant.

- Fill in your personal information along with that of any co-borrower, including names, Social Security numbers, dates of birth, home phone numbers, cell or work numbers, mailing addresses, and email addresses.

- Answer the questions regarding whether the property is listed for sale, including the listing date and any offers received, alongside agent contact information if applicable.

- Disclose any bankruptcy filings, including Chapter type and discharge status, and provide details of any contact with a credit counseling agency, if relevant.

- On the second page, outline your monthly household income, distinguishing between various income sources, and specify your total monthly expenses and debts.

- List your household assets, including checking accounts, savings, real estate, and other valuable items. Compile this information thoroughly as it supports your financial situation.

- Complete the hardship affidavit by specifying the nature of your hardship and indicating when the hardship began. Select the primary reason affecting your ability to maintain mortgage payments and provide supporting documentation as needed.

- Sign and date the form, ensuring that you understand the certifications and agreements regarding the truthfulness of the information provided and your consent for the servicer to review this information.

- Finally, save the completed form, ensuring to download, print, or share it as required to submit along with all pertinent income and hardship documentation.

Complete your Uniform Borrower Assistance Form online today to take the first step towards securing necessary mortgage relief.

A cybersecurity attestation (also more simply known as a cyber attestation) is a review and confirmation of your organization's security status by an independent reviewer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.