Loading

Get 2013 Form 8843. Statement For Exempt Individuals And Individuals With A Medical Condition - Mnsu

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2013 Form 8843. Statement for Exempt Individuals and Individuals With a Medical Condition - Mnsu online

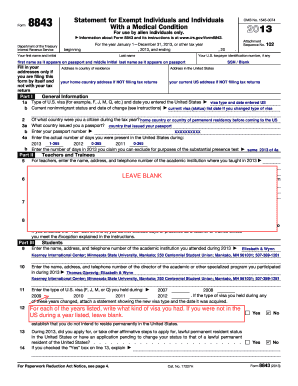

Filling out the 2013 Form 8843 is essential for users who are exempt individuals or have a medical condition that affects their presence in the United States. This guide will provide you with a detailed breakdown of each section of the form, making it easier to complete it correctly online.

Follow the steps to effectively complete your form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete Part I by filling in your name, U.S. taxpayer identification number, and addresses if you are filing the form separately from your tax return.

- In Part I, indicate your U.S. visa type and the date you entered the United States. Also, confirm your current nonimmigrant status.

- Continue with Part II if you are a teacher or trainee, providing the name of the academic institution, your visa details, and noting any prior years you were present in the U.S.

- If you are a student, proceed to Part III and enter the name of your school and the program director's information.

- If applicable, complete Part IV regarding participation as a professional athlete, including details of any charitable events.

- If applicable, fill out Part V where you describe the medical condition that prevented your departure from the U.S. and provide physician details.

- Review the form thoroughly for accuracy, and then sign and date it only if filing it separately from your tax return.

- Finally, save your changes, and choose to download, print, or share the completed form as necessary.

Complete your documentation online today to ensure compliance and avoid penalties.

Who Must File Form 8843? All nonresident aliens present in the U.S. under F-1, F-2, J-1, or J-2 nonimmigrant status must file Form 8843 Statement for Exempt Individuals and Individuals With a Medical Condition even if they received NO income during 2019.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.