Loading

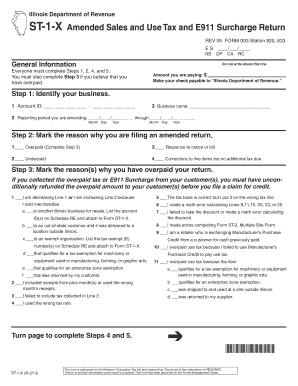

Get Illinois Department Of Revenue St-1-x Amended Sales And Use Tax And E911 Surcharge Return Rev 05

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Illinois Department Of Revenue ST-1-X Amended Sales And Use Tax And E911 Surcharge Return REV 05 online

Filling out the Illinois Department Of Revenue ST-1-X Amended Sales And Use Tax And E911 Surcharge Return REV 05 form online is a straightforward process that helps you amend your sales tax return and manage any discrepancies. This guide will assist you in completing the form accurately and efficiently.

Follow the steps to complete the ST-1-X form online.

- Click ‘Get Form’ button to obtain the form.

- Identify your business by entering your account ID and business name. You will also need to indicate the reporting period you are amending by filling in the start and end date.

- Mark the reason for filing an amended return by selecting one option from the provided list (overpaid, underpaid, response to notice, corrections to line items).

- If you overpaid, indicate the reason(s) why by selecting appropriate choices from the options and specifying details as required in Step 3.

- Correct your financial information by providing the figures that reflect what should have been filed, including amounts for taxable receipts, deductions, and taxes due. Make sure to follow the instructions to complete all applicable lines accurately.

- After completing all sections, sign the form where indicated. Ensure that your declaration of accuracy is completed, and provide the date and contact information.

- Once you have filled out the form, you can save changes, download, print, or share the completed document as needed.

Complete your ST-1-X form online today.

The Internal Revenue Service limits the amount of time you have to file a 1040X to the later of three years from the date you file the original tax return, or two years from the time you pay the tax for that year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.