Loading

Get 48020u Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 48020u Form online

Filling out the 48020u Form online is a straightforward process that can streamline your tax reporting obligations. In this guide, we will provide step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the 48020u Form online.

- Press the ‘Get Form’ button to access the 48020u Form and open it in your preferred online editor.

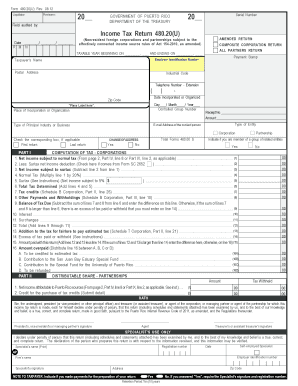

- Begin by entering the year of the return and the serial number in the designated fields. This information is critical for proper filing.

- Provide the taxpayer's name, postal address, employer identification number, and contact information. Ensure that all entries are accurate to avoid delays in processing.

- Specify whether you are submitting an amended return, and indicate if this is your first or last return. Choose the type of entity — either corporation or partnership — and provide the relevant details.

- In Part I, calculate your taxable income by following the provided lines: begin with your net income, deduct any applicable surtax net income, and calculate your total tax owed.

- For partnerships, complete Part II by providing details on your distributable share of income and tax withheld. Make sure to accurately report all values.

- Review the computation of income effectively connected to a trade or business within Puerto Rico in Part IX, if applicable, and complete the necessary calculations.

- Finalize the form by signing and dating it, depending on your role in the organization. Ensure that all necessary attachments are included.

- Save or download your completed form for your records, and if applicable, print or share the form as needed.

Start completing your documents online today for a more efficient filing experience.

Related links form

Form 1099-DIV Form 1099-DIV shows any reported dividend payment received throughout the year. Form 480.6A (Puerto Rico residents only) Form 480.6A reports dividend income and/or gross proceeds less commissions and fees.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.