Loading

Get Indiana Department Of Revenue Form St-137ac State Form ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Indiana Department Of Revenue Form ST-137AC online

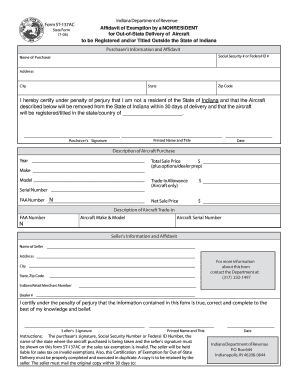

Filling out the Indiana Department Of Revenue Form ST-137AC is an essential step for nonresidents purchasing aircraft intended for out-of-state registration. This guide will provide you with a detailed, user-friendly approach to completing the form online.

Follow the steps to fill out the form accurately.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by entering the purchaser's information. Fill in the Social Security or Federal ID number, name, and address, including city, state, and zip code.

- Certify that you are not a resident of Indiana and that the aircraft will be registered in another state or country. Provide the name of that state or country.

- Sign and date the form. Include your printed name and title to affirm the accuracy of the information provided.

- Next, in the description of the aircraft purchased, enter the year, make, model, serial number, FAA number, and total sale price (including any options or dealer prep fees).

- If applicable, provide details on any trade-in aircraft, including FAA number, make and model, and serial number. Calculate and enter the trade-in allowance and net sale price.

- Provide the seller's information, including the name, address, and Indiana Retail Merchant Number. Ensure the seller’s signature, printed name, and title are included.

- Review the completed form for accuracy and completeness, ensuring that all required signatures and information are present.

- Save changes, download, print, or share the form as necessary. Remember to retain a copy with the seller and mail the original to the Indiana Department of Revenue within 30 days.

Complete your Form ST-137AC online today to ensure a smooth and efficient exemption process.

Related links form

To receive an Indiana sales tax exemption, the organization must file a Nonprofit Application for Sales Tax Exemption (Form NP-20A) and annually file a Nonprofit Organization's Annual Report (Form NP-20) with the Indiana Department of Revenue.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.