Loading

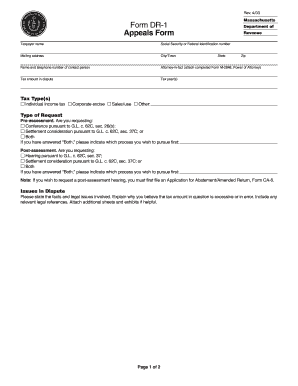

Get Rev. 4/03 Form Dr-1 Appeals Form Revenue - Formsend

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Rev. 4/03 Form DR-1 Appeals Form Revenue - FormSend online

The Rev. 4/03 Form DR-1 is essential for individuals or entities seeking to appeal against tax amounts in contention with the Massachusetts Department of Revenue. This guide will provide you with step-by-step instructions to complete the form accurately and efficiently online.

Follow the steps to complete the appeals form with precision.

- Click ‘Get Form’ button to obtain the form and open it in the available editing tool.

- Begin by filling in the taxpayer name and the corresponding Social Security or Federal Identification number. Ensure the accuracy of this information to avoid delays.

- Provide the mailing address, city/town, state, and zip code of the taxpayer. This information is vital for communication.

- Enter the name and telephone number of a contact person who can be reached for any follow-up questions.

- If applicable, include the attorney-in-fact by attaching a completed Form M-2848, Power of Attorney.

- Specify the tax amount in dispute and the tax year(s). Indicate the type of tax, selecting from individual income tax, corporate excise, sales/use, or other.

- Choose the type of request: pre-assessment or post-assessment. Further clarify whether you are requesting a conference or settlement consideration.

- In the ‘Issues in Dispute’ section, describe the facts and legal issues involved, explaining why you think the assessed tax amount is excessive.

- Complete the ‘Procedural History’ and ‘Settlement Proposal’ sections if you are seeking settlement consideration. Provide detailed responses to each question.

- Review all entered information for accuracy before signing and dating the form. An electronic signature is sufficient here.

- Once all sections are filled out and reviewed, save your changes, and choose to download, print, or share the form as required.

Complete your appeals form online today to ensure a timely and efficient submission.

If you appeal your decision, you must file a notice of appeal with the ATB within 30 days of the date of your decision. See Mass. Rules of Appellate Procedure Rule 4(a). For information about the appeal procedure at the Massachusetts Appeals Court, contact their clerk's office at (617) 725-8106.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.