Loading

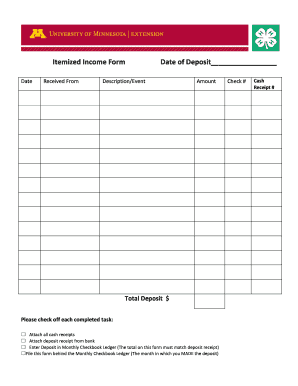

Get 4-h Itemized Income Form - Extension

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 4-H Itemized Income Form - Extension online

Filling out the 4-H Itemized Income Form - Extension online can streamline your record-keeping and ensure accurate financial reporting. This guide provides clear, step-by-step instructions to help you complete the form effectively.

Follow the steps to accurately complete the form online.

- Press the ‘Get Form’ button to access the document and open it in the online editor.

- Enter the date of the income receipt in the designated field, ensuring you input it correctly for accurate tracking.

- In the 'Received From' field, provide the name of the individual or organization from whom you received the income.

- Fill in the 'Date of Deposit' with the specific date the amount was deposited into your account.

- Under the 'Description/Event' section, briefly describe the source of the income or the event for which the funds were received.

- In the 'Amount' field, input the total dollar amount received from the income source.

- Calculate the total deposit by summing the amounts listed and enter this total in the 'Total Deposit $' field.

- Check off each task as you complete it, ensuring that all necessary receipts and documents are attached to support your entries.

- Once you have filled in all relevant fields, verify that the information is accurate and complete.

- Save your changes, and choose to download, print, or share the completed form as needed.

Begin filling out your 4-H Itemized Income Form - Extension online today for efficient record-keeping.

You can get an automatic extension of time to file your tax return by filing Form 4868 electronically. You'll receive an electronic acknowledgment once you complete the transaction. Keep it with your records. Don't mail in Form 4868 if you file electronically, unless you're making a payment with a check or money order.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.