Loading

Get Irs Fillable 1024 Form

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Fillable 1024 Form online

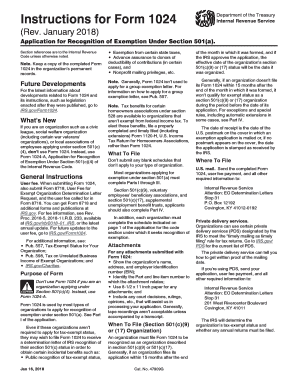

The IRS Fillable 1024 Form is a key document for organizations seeking recognition of tax-exempt status under Section 501(a). This guide will walk you through each section and field of the form to help ensure accurate completion.

Follow the steps to fill out the IRS Fillable 1024 Form online effectively.

- Press the ‘Get Form’ button to access the IRS Fillable 1024 Form and open it in the editor.

- In Part I, fill in the full name and address of the organization as stated in the organizing documents. Be sure to include any alternate names in parentheses.

- For Line 2, enter the nine-digit employer identification number (EIN) assigned to the organization. If the organization does not have one, apply for an EIN through the IRS website.

- Enter the contact person's name and phone number on Line 3. This should be an authorized individual familiar with the organization’s activities.

- Complete Line 4 by entering the month when the organization’s annual accounting period ends.

- For Line 5, provide the date when the organization was legally formed, indicated by the approval of the articles of incorporation.

- Indicate on Line 6 whether the organization has ever submitted an exemption application like Form 1023 or Form 1024.

- Line 7 asks whether the organization has filed federal income tax returns as a taxable or exempt organization; please respond accordingly.

- Specify the type of organization and include the necessary organizational documents on Line 8.

- In Part II, outline the organization’s activities and operational information, including any anticipated changes in financial support.

- Complete Part III with detailed financial data, including statements of revenue and expenses as well as balance sheet information for the current and preceding years.

- Finalize the document by reviewing all entries for accuracy. After completing the form, you can save the changes, download, print, or share the form.

Begin filling out the IRS Fillable 1024 Form online today to ensure your organization receives recognition for tax-exempt status.

Organizations use Form 1024 to apply for recognition of exemption under section 501(a) or to receive a determination letter of IRS recognition of their section 501(c) status.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.