Loading

Get Purchase Assistance Application - Deltona - Deltonafl

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Purchase Assistance Application - Deltona - Deltonafl online

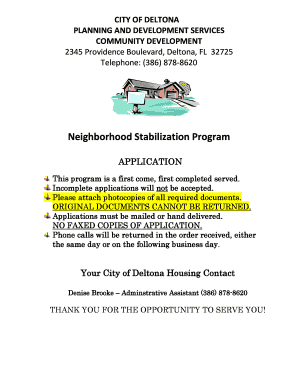

This guide provides a systematic approach to completing the Purchase Assistance Application for the Deltona Neighborhood Stabilization Program online. With clear directions for each section, users can complete the form accurately and efficiently.

Follow the steps to successfully complete the application.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Begin by reviewing the application checklist ensuring you have all required documentation as outlined in the application. This includes proof of household identification, income/assets details, and any necessary court documents.

- In the 'Household Data' section, provide the details on how you heard about the program, the total number of household members, and the total annual gross income.

- Complete the 'Applicant’s Information' section with the legal name, date of birth, age, marital status, race, and income sources of the head of household.

- If applicable, fill in the 'Co-Applicant’s Information' with the same details as above for the co-applicant.

- List any other adult household members and their relevant information, similarly to the applicant and co-applicant sections.

- Include details for household members under the age of 18, noting their name, date of birth, and relationship to the applicant.

- On the 'History/Signature Page,' answer all relevant questions regarding past judgments, foreclosures, or program assistance, and ensure both the applicant and co-applicant sign and date the document.

- Complete the 'Authorization for the Release of Information' section to permit verification of the provided information.

- Fill in the Asset Addendum and Verification of Assets Disposed sections as necessary and ensure accuracy in stating the value of assets.

- Finish with the Affidavit of Home Inspection if applicable, signing to acknowledge understanding of the inspection process.

- Once all sections are completed, review your application for accuracy before saving changes, downloading a copy for your records, or printing it out for submission.

Complete your Purchase Assistance Application online today to begin the process of securing assistance.

With conventional loans, you often only need to put 3% down. With an FHA loan, you'll need to put at least 3.5% down. Through Florida's first-time homebuyer assistance programs, you may be able to get a second loan to cover this down payment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.