Loading

Get 502d Form Declaration Of Estimated 2001 Maryland And ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

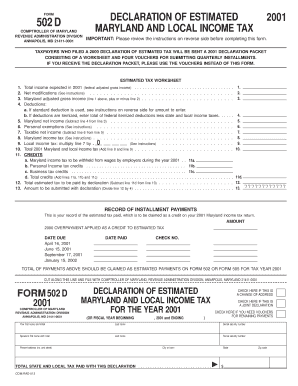

How to fill out the 502D FORM DECLARATION OF ESTIMATED 2001 MARYLAND AND LOCAL INCOME TAX online

Filling out the 502D Form Declaration of Estimated Maryland and Local Income Tax is an important step for ensuring proper tax payments. This guide provides a clear and supportive approach to completing the form accurately and efficiently online.

Follow the steps to complete your tax declaration with ease.

- Click the ‘Get Form’ button to obtain the 502D form and open it in your browser.

- Review the instructions provided on the reverse side of the form for important guidance before filling it out.

- In Section 1, enter your total expected income for the year 2001, which represents your federal adjusted gross income.

- In Section 2, include any net modifications that affect your federal adjusted gross income. Make sure to refer to specific instructions for what to include.

- Calculate your Maryland adjusted gross income in Section 3 by adding or subtracting the modifications from your total income.

- Move to Section 4 where you calculate your deductions. Depending on your filing status, follow the guidelines for either standard or itemized deductions.

- Determine your Maryland net income in Section 5 by subtracting deductions from your adjusted income.

- In Section 6, input your personal exemptions based on your circumstances, considering any applicable credits for dependents or age.

- Compute your taxable net income in Section 7 by subtracting personal exemptions from your net income.

- Calculate the Maryland income tax in Section 8, using the tax rate schedule provided to compute your due tax.

- In Section 9, calculate your local income tax based on your taxable net income, applying the local tax rate from your area.

- Add the amounts from Sections 8 and 9 in Section 10 to find your total 2001 Maryland and local income tax liability.

- Report any credits you are eligible for in Section 11, including withheld taxes and other credits.

- Subtract total credits from your estimated taxes in Section 12 to determine the total estimated tax to be paid.

- Finally, divide the amount in Section 12 by 4 to determine the amount you need to submit with your declaration.

- Once all fields are completed, save your changes. You can then download, print, or share the completed form as needed.

Take action today by filling out your 502D form online and ensure your tax obligations are met promptly.

Generally, you are required to file a Maryland income tax return if: You are or were a Maryland resident; You are required to file a federal income tax return; and. Your Maryland gross income equals or exceeds the level listed below for your filing status.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.