Loading

Get W2 E-filing - City Of Lansing

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W2 E-Filing - City Of Lansing online

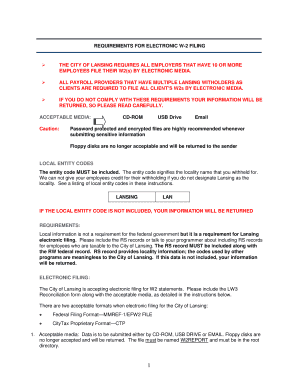

Filing the W2 E-Filing - City Of Lansing electronically is essential for employers with ten or more employees. This guide provides clear, step-by-step instructions to help you complete the form accurately and ensure compliance with local requirements.

Follow the steps to successfully complete your W2 E-Filing

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the employer information at the top of the form. Include your Employer FEIN or Tax ID, tax year, and employer name, ensuring that names and addresses do not contain any punctuation, like commas.

- Next, provide the corporate designation if applicable, and fill in the employer's street address, city, state, and zip code, ensuring that all entries are in uppercase letters.

- For each employee, start on a new line and enter their personal information, including Social Security Number, names, and addresses. Each line should correspond to a single employee.

- Fill out the wage details for each employee, including federal wages, local entity code, local withholding, Social Security wages, Medicare wages, local wages, and total deferred amounts as per the form fields.

- Make sure to include the local entity code for Lansing (LAN) in the respective field to ensure that employees receive credit for their withholding.

- Once all fields have been accurately filled in, save your changes by selecting the ‘Save As’ option. Name the file W2REPORT & FEIN and choose the CSV (Comma Delimited) format for saving.

- To submit the completed form, email it along with the LW3 report to withholding@lansingmi.gov, ensuring that the subject line contains 'W2REPORT' and your FEIN. Alternatively, you can also save the file to a USB drive or CD and mail it if you have fewer than ten employees.

Complete your W2 E-Filing online today to meet local requirements and avoid any processing delays.

All Detroit residents are required to pay the City of Detroit taxes regardless of where you work. Employers located in Detroit are required by law to withhold City of Detroit income tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.