Loading

Get Form 68 Online

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 68 Online

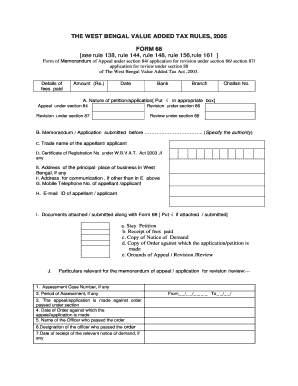

Filling out Form 68 Online is an essential step for individuals seeking to submit a memorandum of appeal or an application for revision under the West Bengal Value Added Tax Act, 2003. This guide will help you navigate through each section of the form with clarity and ease.

Follow the steps to complete Form 68 Online effectively.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering the details of the fees paid, including the amount, date, bank, branch, and challan number.

- Select the nature of your petition/application by placing a check in the appropriate box for ‘Appeal under section 84’, ‘Revision under section 86’, ‘Revision under section 87’, or ‘Review under section 88’.

- Specify the authority before which the memorandum/application was submitted.

- Input the trade name of the appellant/applicant and the Certificate of Registration number under the West Bengal Value Added Tax Act, 2003, if applicable.

- Fill in the address of the principal place of business in West Bengal and any alternative address for communication.

- Provide the mobile telephone number and email ID of the appellant/applicant.

- List and check the documents that are attached or submitted along with Form 68, such as the stay petition, receipt of fees, notice of demand, and grounds of appeal.

- Complete the particulars relevant for the memorandum of appeal/application, including assessment case number, period of assessment, date of order, and name of the officer who passed the order.

- Detail the particulars of provisional assessment or any other assessment relevant to your application, including various turnover figures and admitted amounts.

- Provide particulars of any disputed amounts, including turnover, tax credits, and penalties.

- In the grounds section, enter the reasons for your appeal, revision, or review petition.

- Finalize the form by verifying all the details, signing, and dating it in the designated areas.

- Once completed, you can save changes, download, print, or share the form as needed.

Complete your Form 68 Online today to ensure your submission is processed efficiently.

Section 270AA of the Income Tax Act empowers an AO to grant immunity from imposition of penalty (Section 270A) as well as initiation of prosecution proceedings (Section 276C and 276CC) for underreporting of income on specific terms and conditions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.