Loading

Get Form 588 - Witholding Waiver Request - Mysmartlease

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

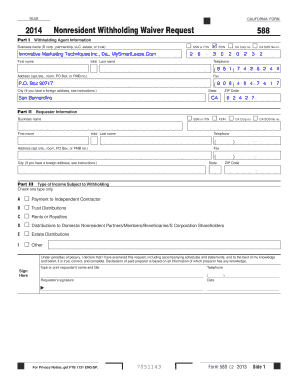

How to fill out the FORM 588 - Withholding Waiver Request - MySmartLease online

This guide provides clear instructions on how to effectively complete the FORM 588 - Withholding Waiver Request online. Whether you are familiar with tax forms or new to this process, these step-by-step instructions will assist you in filing your request accurately.

Follow the steps to complete your withholding waiver request.

- Click 'Get Form' button to obtain the form and open it in the editor.

- In Part I, enter the withholding agent information. Specify whether you are providing a FEIN, CA Corporation number, CA SOS file number, SSN, or ITIN by checking the appropriate box. Provide the business name, first and last name, telephone number, and complete address.

- In Part II, provide the requester information. Similar to Part I, indicate the type of identification number being used and supply the requester’s business name, first and last name, telephone number, and address.

- In Part III, identify the type of income subject to withholding by checking only one type. Options range from payment to independent contractors to estate distributions.

- In Part IV, complete the Schedule of Payees. For each payee, indicate whether you are using a SSN, FEIN, CA Corporation number, or CA SOS file number. Provide their business name, first and last names, addresses, and select the reason for the waiver request by checking the corresponding box.

- If applicable, attach any required documentation that supports your waiver request, especially if you are choosing ‘Other’ as a reason and need to provide justification.

- Review all entries for completeness and accuracy. Remember to sign and date the form at the designated area.

- Once you have filled out the form, save your changes. You can then download, print, or share the form as needed.

Begin filling out your FORM 588 - Withholding Waiver Request online today.

If your LLC has one owner, you're a single member limited liability company (SMLLC). If you are married, you and your spouse are considered one owner and can elect to be treated as an SMLLC. We require an SMLLC to file Form 568 , even though they are considered a disregarded entity for tax purposes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.