Loading

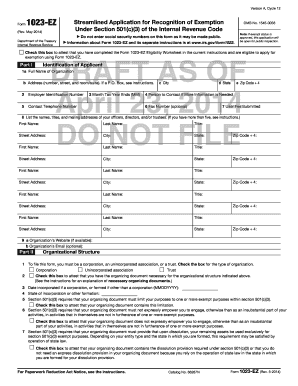

Get Form 1023-ez (rev. May 2014) - Internal Revenue Service - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1023-EZ (Rev. May 2014) - Internal Revenue Service - Irs online

Filling out Form 1023-EZ is a critical step for organizations seeking tax-exempt status under section 501(c)(3) of the Internal Revenue Code. This guide provides clear, step-by-step instructions to help users complete the form efficiently and accurately online.

Follow the steps to complete the Form 1023-EZ online.

- Click ‘Get Form’ button to obtain the Form 1023-EZ and open it in your editor.

- Begin by providing the identification details of your organization. This includes the full name, address (including city, state, and zip code), employer identification number, and contact telephone number.

- Input the month your tax year ends and provide the name and contact details of a person who can provide more information, if needed.

- Complete Part I by listing the officers, directors, and/or trustees of your organization, including their names, titles, and addresses. If you have more than five, refer to the provided instructions.

- In Part II, indicate your organization’s structure (corporation, unincorporated association, or trust). Remember to attest that you have the necessary organizing document for your structure.

- Provide the date of incorporation or formation and the state where your organization is incorporated. Ensure your organizing document includes the required provisions under section 501(c)(3).

- Proceed to Part III, where you will enter the NTEE code that describes your organization. Ensure to check the purposes that apply to your organization to demonstrate exclusivity in operations.

- Fill out the necessary affirmations regarding your activities, including prohibitions and restrictions you will adhere to as a section 501(c)(3) organization.

- If seeking public charity status, complete Part IV by checking the appropriate box(s) to demonstrate your support from public sources. If you are a private foundation, confirm the necessary provisions in your organizing document.

- Complete Part V if applicable, ensuring to declare your intent for reinstatement if your exemption status has been revoked.

- Finally, in Part VI, ensure to type or print the name, title, and date of the person authorized to sign the application and include their signature.

- Review all information to ensure accuracy before saving your changes. You can then download, print, or share the completed Form 1023-EZ.

Start completing your Form 1023-EZ online today for a smoother application process.

Any organization that has gross receipts in each taxable year of normally not more than $5,000. Only certain organizations are eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. To determine if you are eligible to file Form 1023-EZ, you must complete the Form 1023-EZ Eligibility Worksheet.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.