Loading

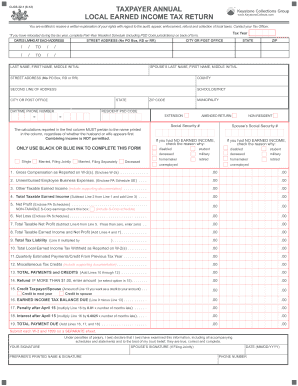

Get Taxpayer Annual Local Earned Income Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the taxpayer annual local earned income tax return online

Filing your taxpayer annual local earned income tax return online is an essential step to ensure you comply with local tax regulations. This guide provides clear, user-friendly instructions to help you navigate and complete the form efficiently.

Follow the steps to accurately complete your tax return online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your personal information at the top of the form, including your name, address, social security number, and filing status. Make sure to provide accurate and current details.

- Indicate your residence information and the associated resident PSD code. This code is necessary for tax identification.

- Report your gross compensation on line 1. Use your W-2 forms to determine your reportable earnings and attach them accordingly.

- If applicable, deduct any allowable employee business expenses on line 2 by enclosing form PA-UE.

- Complete line 3 by inputting any other taxable earned income that has not been reported elsewhere on the form.

- Calculate total taxable earned income by subtracting line 2 from line 1 and adding line 3 as indicated on line 4.

- If you have business income, report net profits on line 5 and net losses on line 6, ensuring to include the necessary supporting documentation such as PA schedules.

- Proceed to line 7 to determine the total taxable net profit by subtracting line 6 from line 5. Report your local earned income tax liability on line 9 by multiplying the total earnings reported on line 8 by your applicable tax rate.

- Claim any local tax withheld as reported on your W-2 forms on line 10, ensuring it does not exceed your total tax liability.

- Report any quarterly estimated payments or credits from the previous year on line 11.

- List any miscellaneous credits on line 12, including necessary supporting documentation.

- Add up all payments and credits to complete line 13.

- If your tax liability on line 9 is less than your total payments and credits on line 13, enter the refund amount on line 14.

- If you owe taxes, input that amount on line 16. Additionally, fill out lines 17 and 18 for any applicable interest and penalties if late.

- Calculate the total amount due on line 19 by summing up lines 16, 17, and 18.

- Review all information carefully to ensure accuracy before submitting.

- Once completed, users can save changes, download, print, or share the form as needed.

Begin filing your taxpayer annual local earned income tax return online today for a convenient and hassle-free experience.

Local taxes are in addition to federal and state income taxes. Local income taxes generally apply to people who live or work in the locality. ... Or if the local income tax is an employer tax, you must pay it. Local income taxes are typically used to fund local programs, such as education, parks, and community improvement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.