Loading

Get Rpd-41096, Application For Extension Of Time To File - State Of New ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

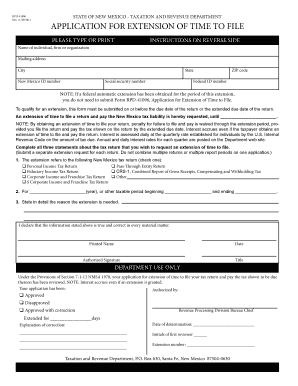

How to fill out the RPD-41096, Application For Extension Of Time To File - State Of New Mexico online

Filling out the RPD-41096 form can be a straightforward process when you have the right guidance. This guide will help you understand each component of the application to ensure your extension request is completed accurately and submitted on time.

Follow the steps to successfully complete the application.

- Press the ‘Get Form’ button to obtain the application and open it in your online editor.

- In the first section, provide the name of the individual, firm, or organization. Make sure to type or print clearly to avoid any issues.

- Fill in the mailing address, including the city, state, and ZIP code. Ensure these details are accurate for the correspondence.

- Enter the New Mexico ID number and Social Security number in the designated fields. If applicable, also include the Federal ID number.

- In the section requesting the extension date, specify the new date you wish to have for filing your return.

- Complete the three statements regarding the tax return for which you are requesting an extension. Make sure to check the appropriate box for the type of tax return.

- Indicate the year or taxable period for which the extension is being requested, and fill in the start and end dates of that period.

- Provide a detailed reason for the extension. Be clear and concise, as this will help validate your request.

- Sign and print your name, date the application, and if applicable, include your title. If someone else is signing on your behalf, ensure they indicate their relationship to you.

- Once you have completed the application, save your changes. You may also choose to download, print, or share the form as needed.

Complete your documents online for an easier filing process!

Generally, state law follows the federal rules for extension of time to file your personal individual income tax return. ... In many states, no additional filing is required after you have filed your federal form 4868, while other states a filing is required, particularly when paying tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.