Loading

Get Fbar & Form 8938 Organizer For - Cpa Websites At Cch Site ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the FBAR & FORM 8938 ORGANIZER online

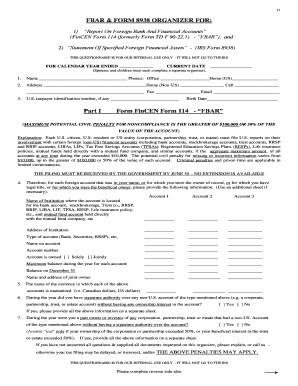

This guide provides comprehensive instructions on how to accurately complete the FBAR & Form 8938 Organizer. Whether you're filing for the first time or are familiar with the process, this guide will offer clear and supportive steps to help you fulfill your filing obligations.

Follow the steps to complete your FBAR & Form 8938 Organizer accurately.

- Press the ‘Get Form’ button to access the FBAR & Form 8938 Organizer in your online editor.

- Begin by filling in your personal information including your name, phone numbers, and addresses. Be thorough to ensure that all fields are completed accurately.

- Provide your U.S. taxpayer identification number if applicable.

- For Part I related to the FBAR, list your foreign accounts. For each account, indicate the institution's name, address, type of account, account ownership status (solely or jointly), and maximum balance during the year.

- Make sure to list the currency of each account maintained and provide details of any signature authority over non-U.S. accounts.

- In Part II for IRS Form 8938, list any specified foreign financial assets you hold, excluding those covered in Part I. Describe each asset comprehensively, including identifying information and its maximum value during the year.

- Review the form and ensure all questions are answered. If you need additional space, use a separate sheet as needed.

- Once you have completed all sections, you can save changes, download, print, or share the form as necessary.

Complete your FBAR & Form 8938 Organizer online today to meet your filing requirements.

Criminal FBAR Penalty (Willful Violations) Willful failure to file: A fine up to $250,000, 5 years in prison, or both. Willful failure to file in concurrence with another crime (such as tax evasion): A fine up to $500,000, 10 years in prison, or both.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.