Loading

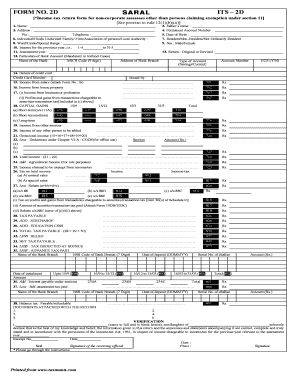

Get Form No. 2d Saral Saral Its 2d - Iitk Ac

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM NO. 2D SARAL SARAL ITS 2D - Iitk Ac online

This guide provides clear, step-by-step instructions for filling out the FORM NO. 2D SARAL SARAL ITS 2D - Iitk Ac online. Designed for individuals unfamiliar with tax forms, it will help you navigate each section effectively.

Follow the steps to complete your form successfully.

- Press the ‘Get Form’ button to access the document and open it in your preferred digital editor.

- Begin by filling out the name section. Ensure it is written in capital letters for consistency.

- Next, enter your address including the postal pin code and telephone number accurately.

- Indicate your status as either an individual, Hindu Undivided Family, firm, association of persons, or local authority by marking or inputting the relevant option.

- Provide your ward, circle, or special range details in the designated field.

- Fill in the income details for the previous year and the assessment year accordingly.

- Complete the particulars of your bank account. This section is mandatory if you expect a refund.

- Declare your father's name and enter your Permanent Account Number (PAN).

- Indicate your date of birth and resident status (resident, non-resident, or not ordinarily resident).

- Specify your gender and whether you are submitting an original or revised return.

- Provide detailed information regarding income sources, including salary, house property, business or profession, capital gains, and any income from other sources, as specified in the form.

- Clearly state any exemptions you are claiming and calculate your total income.

- List deductions under Chapter VI-A and calculate your net tax payable, while noting any rebates applicable.

- Finally, review your filled form for accuracy before saving your changes. You can download, print, or share the completed form.

Complete your filing online today to ensure compliance and timely submission.

Individuals residing in India with a total income of up to Rs 50 lakh are eligible. ITR-1 may be filed by someone who earns money from a job, a home, or other outlets. An NRI is unable to file an ITR-1. ITRs may be filed using Form 16 by salaried taxpayers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.