Loading

Get A Pass-through Entity (entity) As Defined In Idaho Code Section 63-3006c Includes A Partnership

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the A Pass-through Entity as defined in Idaho Code Section 63-3006C online

This guide provides a comprehensive overview of how to complete the A Pass-through Entity form in a user-friendly online format. Whether you are familiar with the process or are a first-time user, this step-by-step guide will assist you in accurately filling out the necessary information.

Follow the steps to complete the form effectively.

- Click 'Get Form' button to obtain the form and open it in the editor.

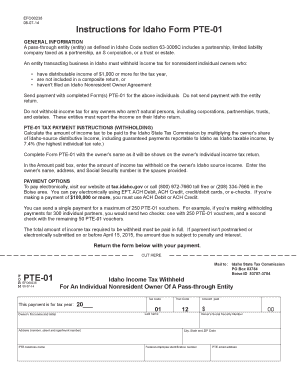

- Identify the tax year for which you are filing by entering it in the designated field. This typically requires a four-digit year, such as 2023.

- In the 'Owner's first name and initial' field, input the first name and middle initial of the owner for the corresponding tax year.

- Fill in the last name of the owner in the respective field directly following the first name.

- Enter the complete address of the owner, including the street number, street name, apartment number (if applicable), city, state, and ZIP code.

- Input the name of the PTE business in the 'PTE business name' section to identify the business entity associated with this form.

- In the 'Owner's Social Security Number' field, provide the owner's Social Security number as required.

- Indicate the total amount of income tax being paid in the 'Amount paid' box, ensuring it reflects the calculated withholding amount based on the owner's distributive income.

- If applicable, enter the Federal employee identification number of the PTE in the appropriate field.

- Provide an email address for the PTE, if available, ensuring it is accurate for any communications regarding this submission.

- Review all entered information for accuracy before proceeding to save or submit the form.

- Once complete, save your changes, and you can choose to download, print, or share the form according to your needs.

Complete your documents online to ensure a smooth filing process.

For the purposes of this section, "contribution" means monetary donations reduced by the value of any benefit received in return such as food, entertainment or merchandise.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.